Corporate Bond Trading Cost Update

Virtually all size and type trade costs have fully returned to pre-pandemic levels

In our prior piece (BondWave Trade Insights – Volume 15) we took a deep dive into fixed income trading costs before, during, and after the spike in market volatility related to the pandemic.

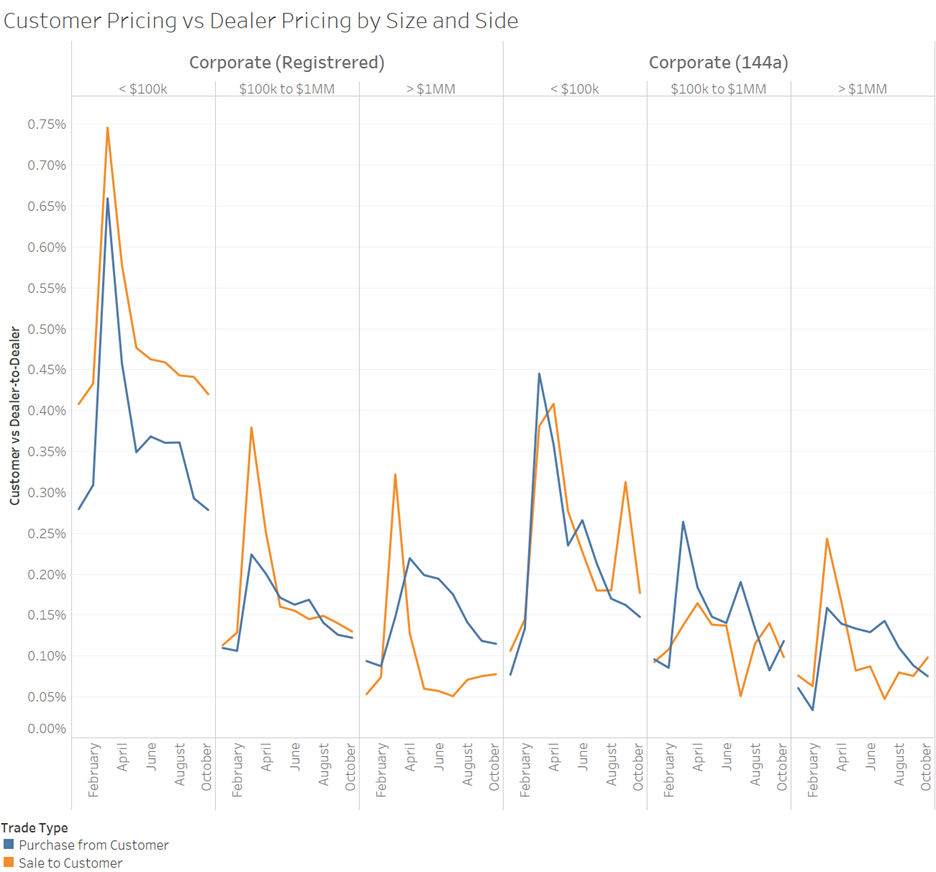

Below we examine the corporate bond subset of the data updated through the end of October. The difference between where customer trades are priced and where the inter-dealer market is priced has reverted to pre-pandemic levels. With the exception of small trades in 144a securities (<$100k), all trade costs are within 5 basis points of where they were in January and February.

To learn more, contact us at

info@bondwave.com