Insight into every fixed income position and transaction – every time.

BondWave’s Effi platform leverages data science and emerging technologies to develop unique data sets that provide enhanced insights. Effi delivers solutions that can help you save time, support regulatory requirements – and build lasting client relationships.

Contact a specialistTrusted by top financial institutions ranging from the largest wealth managers to the smallest RIAs

Trusted by top financial institutions

24+

Year History

150+ years

Management experience

5M+

Positions analyzed

1B+

Fair values calculated

Benefit from BondWave’s breakthrough:

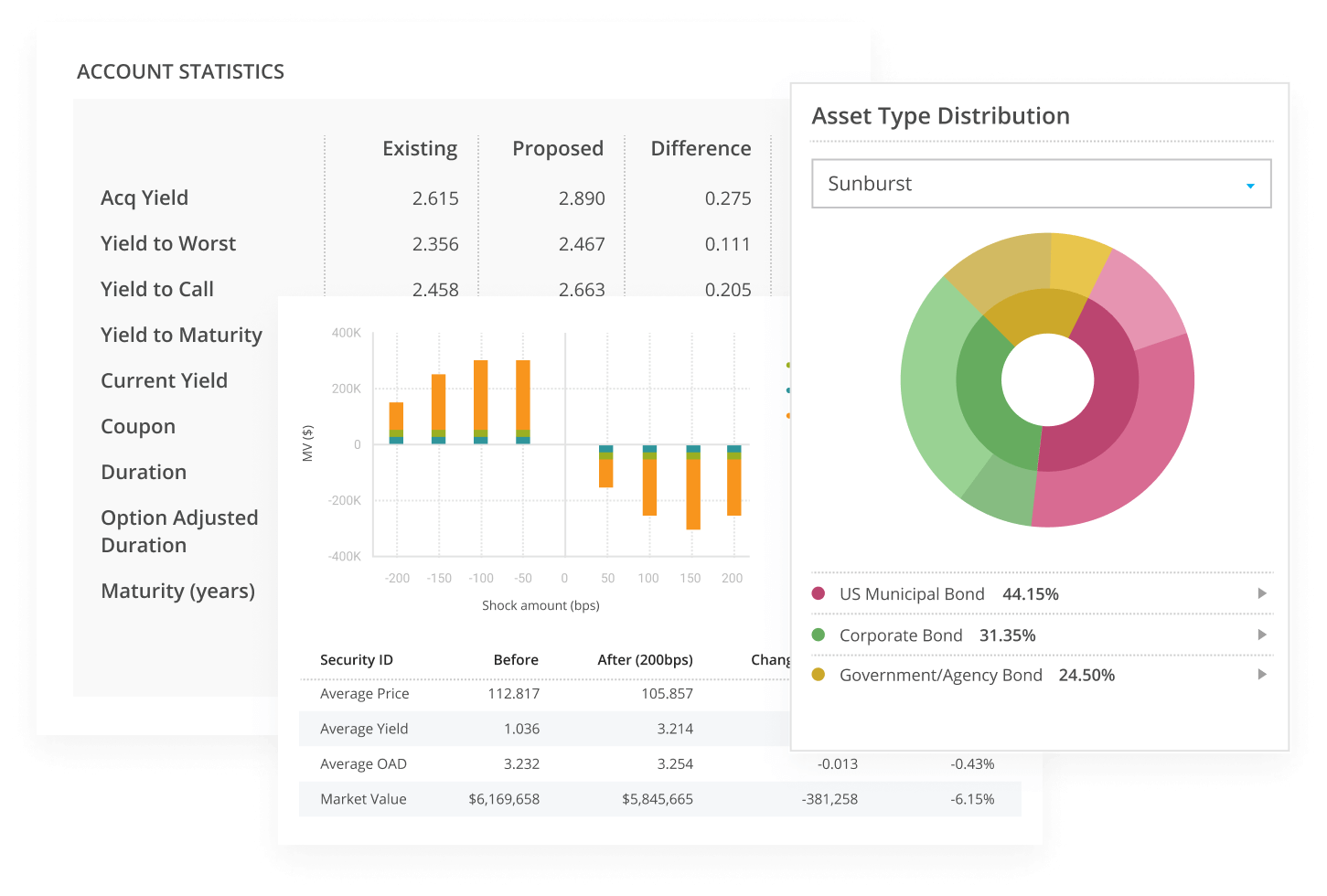

Portfolio Analytics

BondWave® customizes Effi for you, shaping the solution to fit your needs. Here are offerings that can be part of your solution: Accounts & Positions, Reports, Proposals, BondAlert

Leveraging a massive fixed income data warehouse, Effi portfolio analytics allows our clients complete command of every bond position. Actionable dashboards and customizable alerts allow firms to efficiently service accounts. A sophisticated and customizable digital reporting framework enables a more personal experience with your clients.

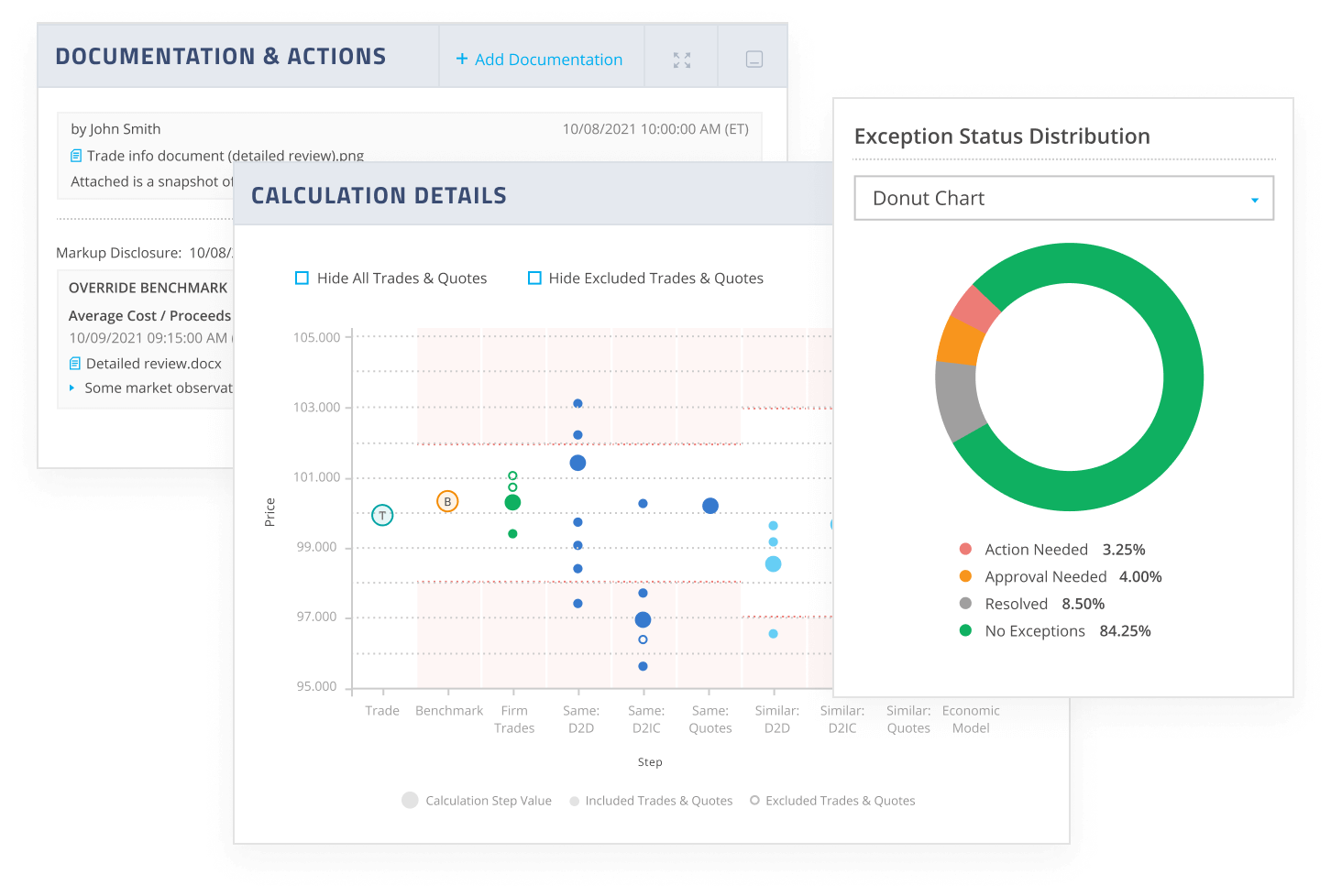

Explore moreTransaction Analytics

BondWave® customizes Effi for you, shaping the solution to fit your needs. Here are offerings that can be part of your solution: Market Calculator, Trade Oversight, Transaction Quality Analysis

Effi transaction analytics provides a robust process that evaluates execution quality and supports compliance requirements. From pre-trade price confidence to post-trade execution efficiency and exception handling, Effi provides tools to assist you with Fair Pricing / Markup Disclosure, Best Execution, and Transaction Quality Analysis.

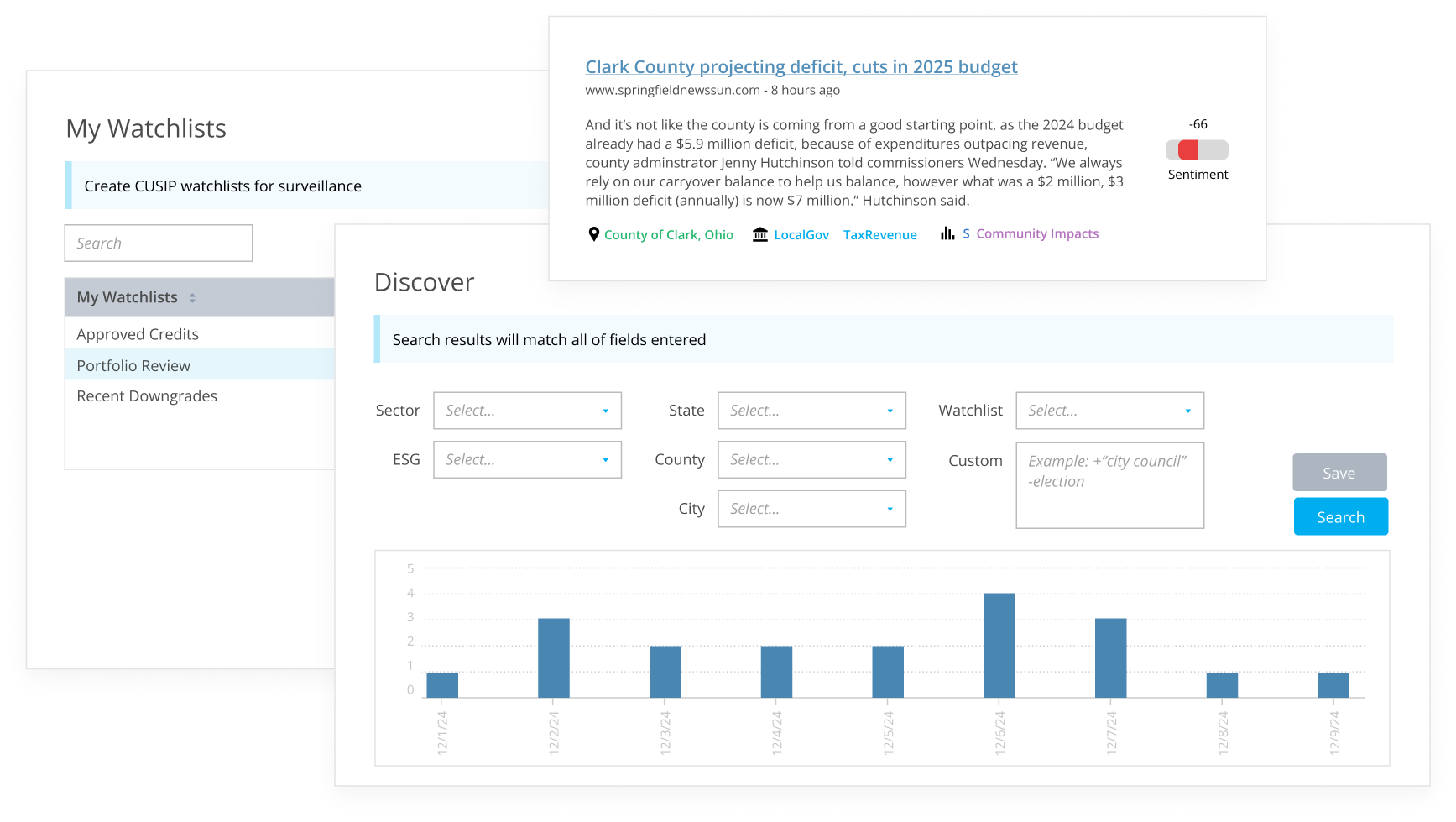

Explore moreBitvore Muni News

Bitvore Muni News is the first Artificial Intelligence (AI) product to give you instant access to clear and pro-active news about changes in any muni obligor and CUSIP.

Effortlessly stay on top of changes in your portfolio and obligors. Bitvore automatically reads and catalogs material news that impacts credit risk from over 60,000+ unique sources of data. You receive important news that directly impacts your portfolio or obligor of interest.

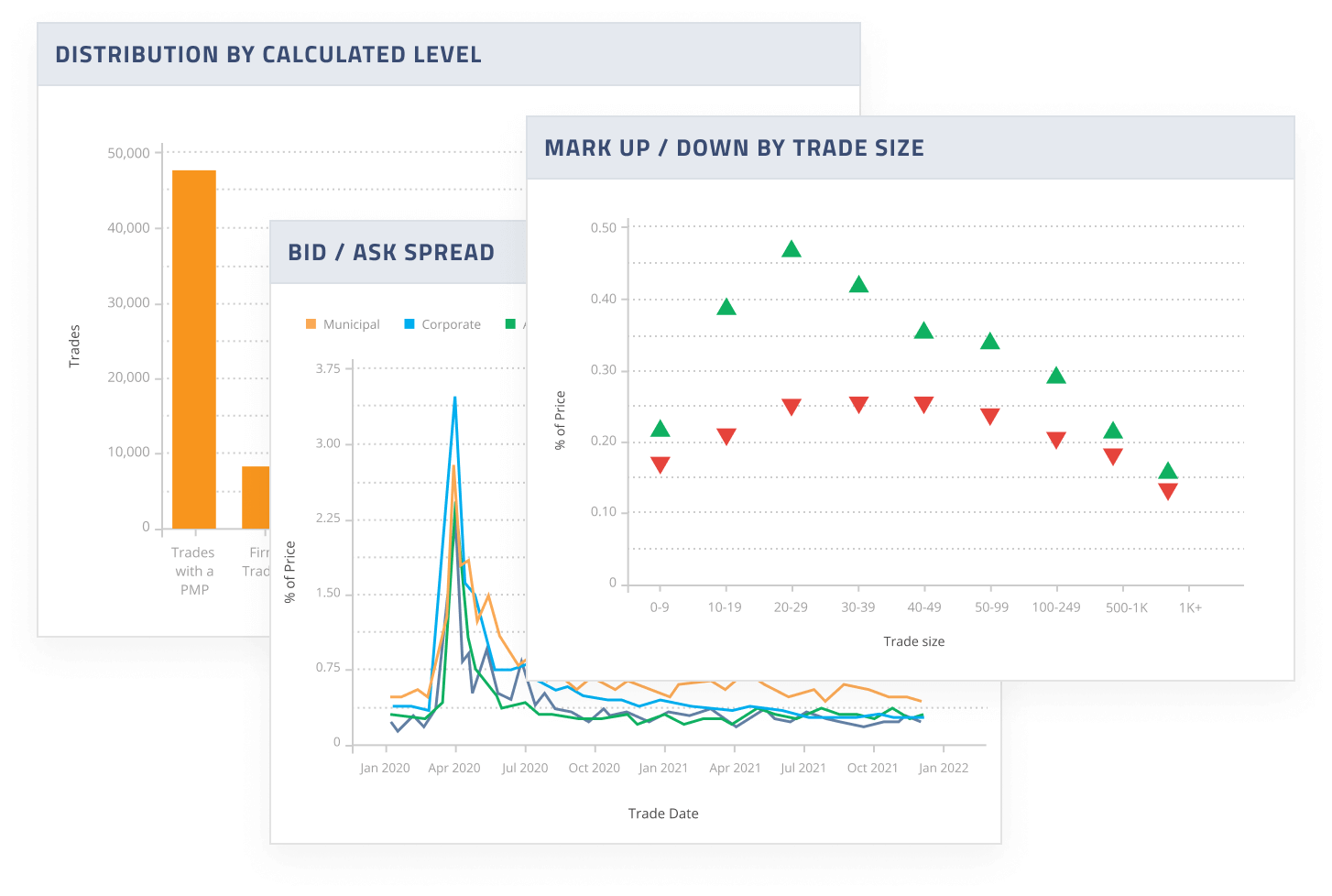

Explore moreData Lab

BondWave® customizes Effi for you, shaping the solution to fit your needs. Here are offerings that can be part of your solution: QMarks, QCurves, QTrades, QScores

The Data Lab is BondWave’s team of data scientists, tasked with driving innovation. The Lab applies advanced technologies to create unique data sets that power new levels of insight and transparency. Our proprietary data sets include trade benchmark data, enriched trade data, municipal yield curves, and identification of comparable bonds.

Explore moreThe right tool for the job

Effi’s architecture makes it all possible

Benefits by User Group

Effi was built as a singular platform that provides value to all business stakeholders

Legal, Compliance, and Risk professionals leverage Effi to manage risk and support critical regulatory requirements

DiscoverTraders and liaisons are able to effectively monitor portfolios, identify trade opportunities, and measure execution quality on both a pre- and post-trade basis

DiscoverEnhance client interactions with superior information and customized reports to build confidence and help promote longstanding relationships.

Discover“This the first product in fixed income… forget just fixed income… the first product that I’ve ever used that does everything it is supposed to do and more!”

– Rich McDonald, Moneta Group

“BondWave is our consistent go-to for advisors or clients who have a high allocation in fixed income”

– BondWave Client

Effi covers all your fixed income needs:

Comprehensive

Our data warehouse provides descriptive and event information across the entire bond universe.

Timely

Real-time data provides for prompt bond alerts and calculations based on the latest market information.

Accurate

Reports and calculations leverage our data warehouse and are enhanced by the latest data science.

Customizable

Configure your view to get the information you need, in the way you want it.

12

fixed income asset types

7.3M +

active securities

90 +

customizable event types

120M +

bond events in the database

185M +

Transactions evaluated

750M +

Steps calculated

Big change is big news. Read all about it.

Everything you need to control your bond business

Have more questions?