Quote Activity

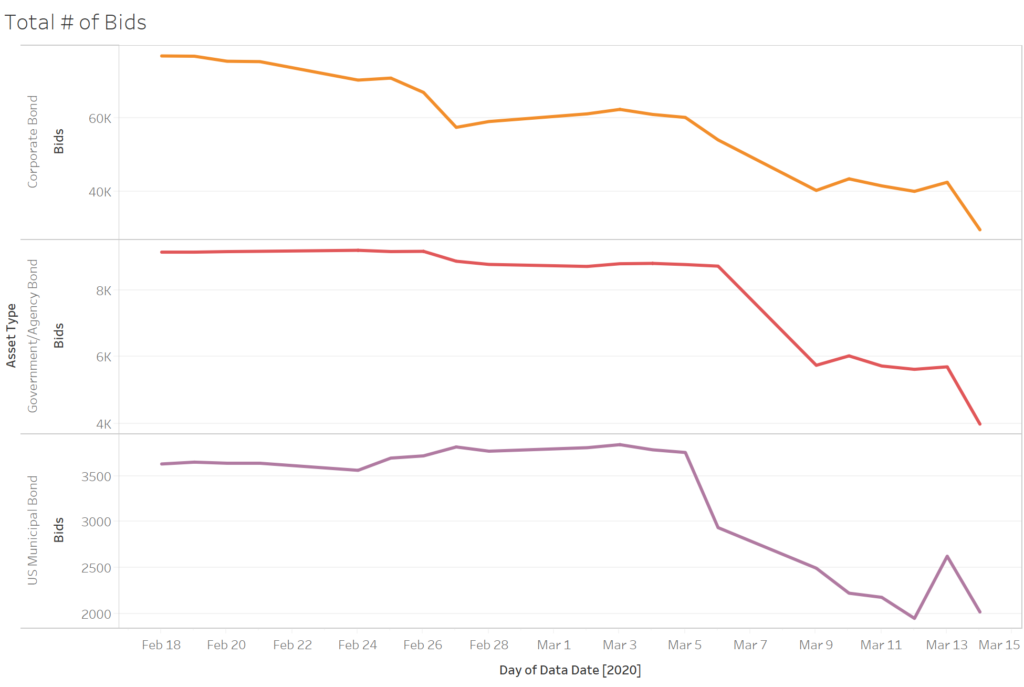

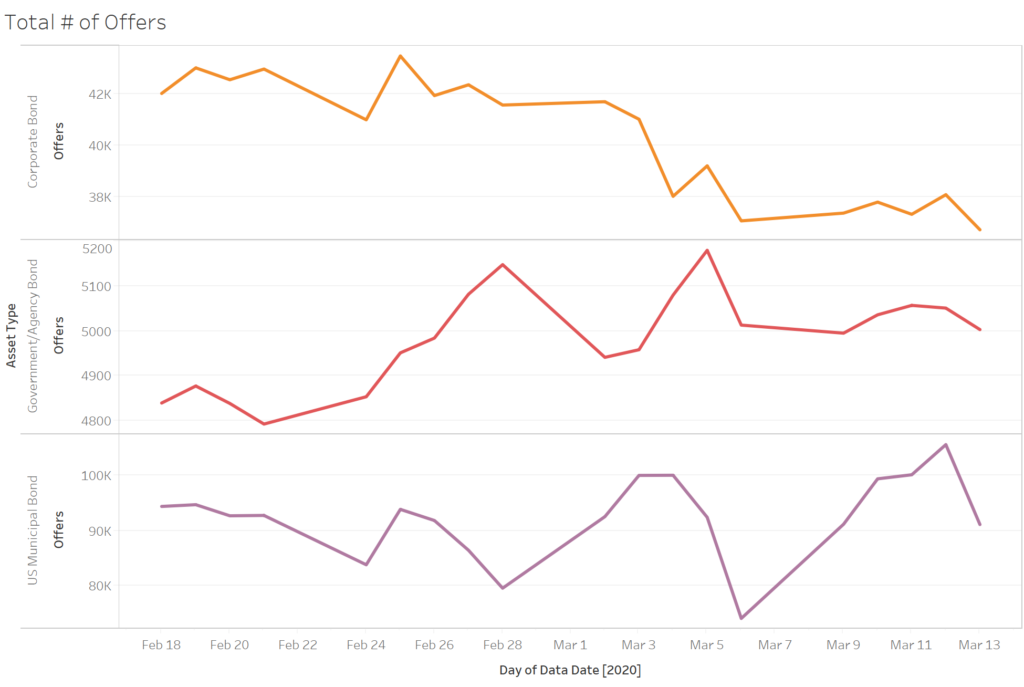

With the extreme volatility in the fixed income market, participants have altered their quoting patterns. As expected in a falling market, standing bids on ATS’s have begun to dry up while offer activity remains strong.

The following two charts show the total number of unique bids and offers per day on ICE BondPoint for the past month. Measurements are taken in 15-minute increments. Bids are down across the board while offers remain relatively stable in Government/Agency and Municipal bonds.

Source: ICE BondPoint

Source: ICE BondPoint

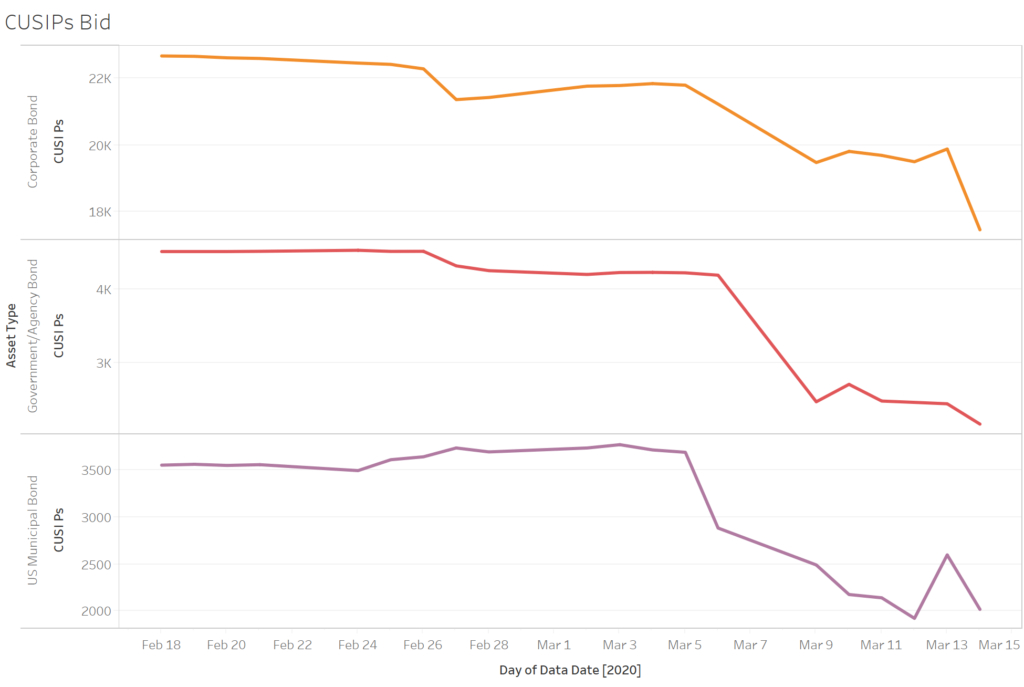

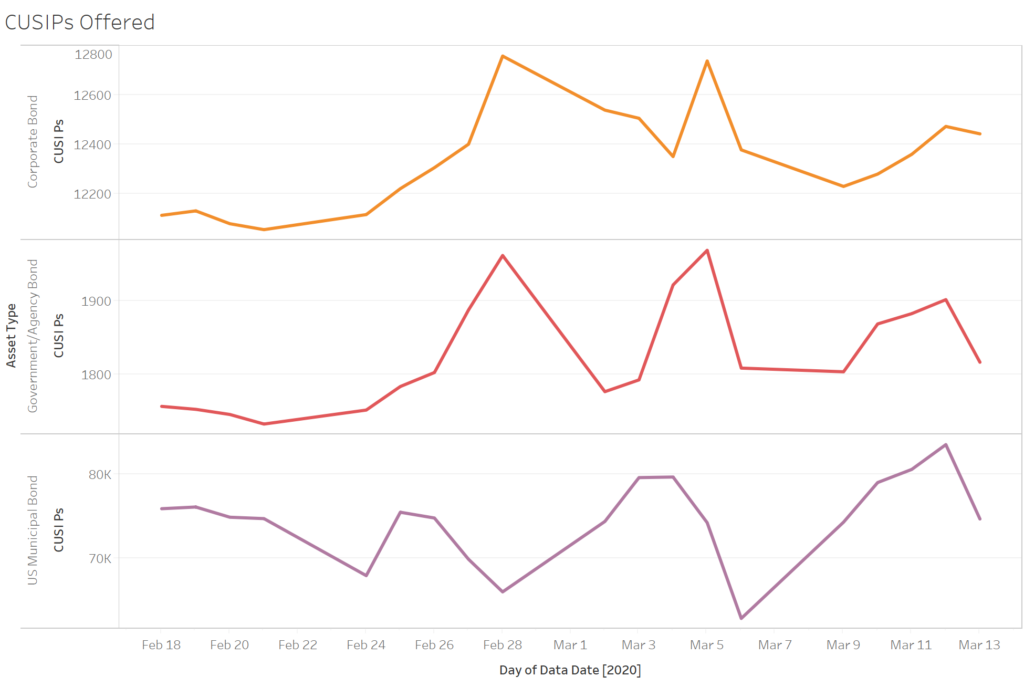

It can also be useful to examine the number of unique CUSIPs that are being bid for and offered over time. The following two charts show the total number of unique CUSIPs being bid for and offered per day on ICE BondPoint for the past month.

Source: ICE BondPoint

Source: ICE BondPoint

Unsurprisingly, the number of CUSIPs being bid for has shrunk along with the total number of bids. However, on the offer side the number of Corporate CUSIPs is relatively stable even as the number of offers has shrunk indicating fewer people offering the same number of bonds.