Fixed Income Market Reaction to Equity Market Selloff

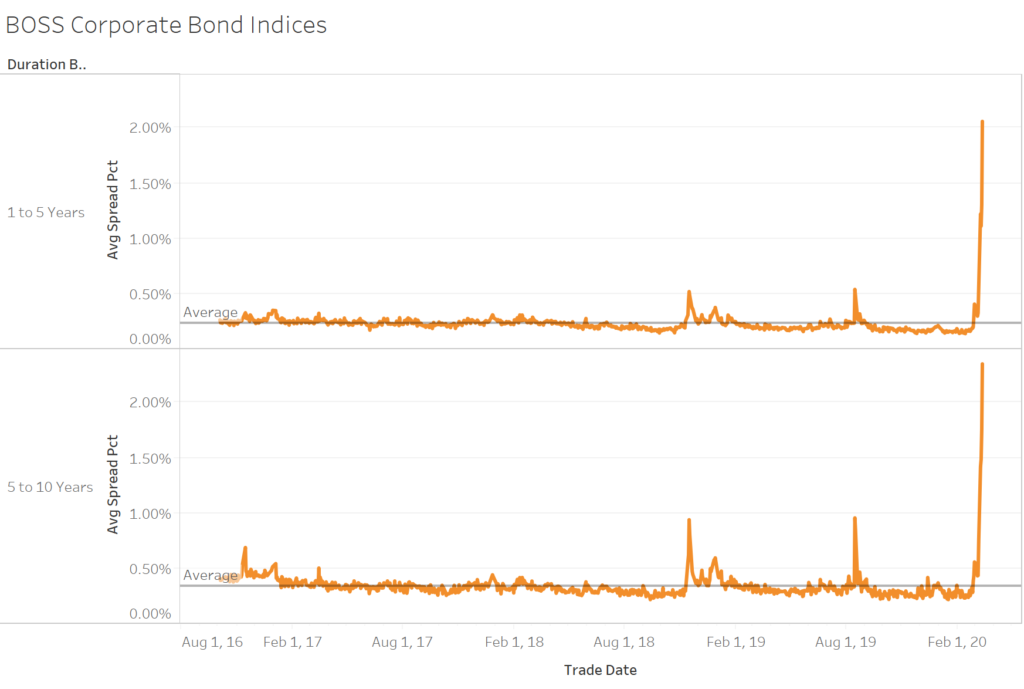

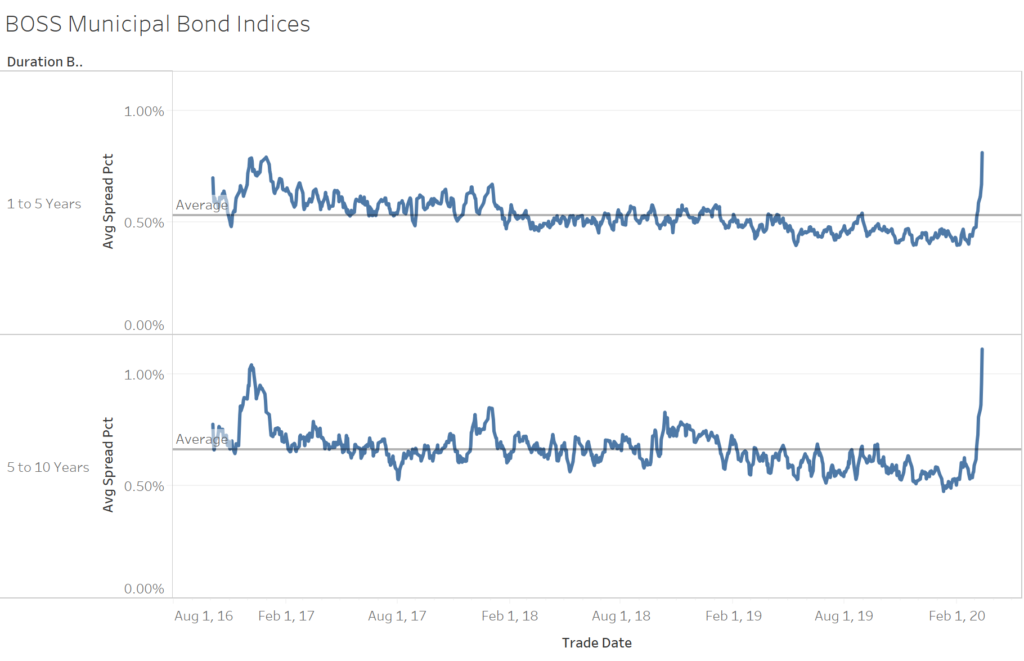

With concern about the impact to economic activity of the COVID-19 virus being blamed for the recent steep selloff in equities, we are also seeing an impact on the cost of trading liquid, investment grade corporate bonds. The BondWave Benchmark Data and Trading Indices includes two corporate bond bid-offer spread indices. The BondWave Bid-Offer Spread Service (BOSS) measures the width of the bid-offer spread in the dealer-to-dealer market for A and BBB rated corporate bonds as well as the bid-offer spread in the dealer-to-dealer market for AA and A municipal bonds.

Corporate Bond Liquidity Cost Rising to New Highs

Corporate bond bid-offer spreads have risen to their highest level Thursday. With the selloff in equities gaining speed on Thursday, the cost of liquidity in corporate bonds also reacted sharply. The BOSS 1 to 5 Year Corporate Index hit 2.06% on 3/12/2020 while the BOSS 5 to 10 Year Corporate Index hit 2.35%. Under normal market conditions corporate bonds have a narrower bid-offer spread than municipal bonds. As of Thursday, liquidity in the corporate bond market was roughly twice as expensive as liquidity in the municipal bond market.

It is important to note there is measurement bias at work in the data too. The companies most likely to be impacted by a COVID-19 drag on economic activity are also the most likely to trade. This can cause widening of the average bid-offer spread that is greater than the actual average as bonds that are less impacted are also less represented in the data.

Source: BondWave BDTI

Municipal Bonds Continue to React

Municipal bond bid-offer spreads moved well above their historic average on Thursday and are now at the high end of their historic range. The BOSS 1 to 5 Year Muni Index rose to 0.81% on Thursday. Meanwhile, the BOSS 5 to 10 Year Muni Index rose to 1.11%.

Source: BondWave BDTI