Fixed Income Market Reaction to Equity Market Sell Off

With concern about the impact to economic activity of the COVID-19 virus being blamed for the recent steep sell off in equities, we are also seeing an impact on the cost of trading liquid, investment grade corporate bonds. The BondWave Benchmark Data and Trading Indices includes two corporate bond bid-offer spread indices. The BondWave Bid-Offer Spread Service (BOSS) measures the width of the bid-offer spread in the dealer-to-dealer market for A and BBB rated corporate bonds as well as the bid-offer spread in the dealer-to-dealer market for AA and A municipal bonds.

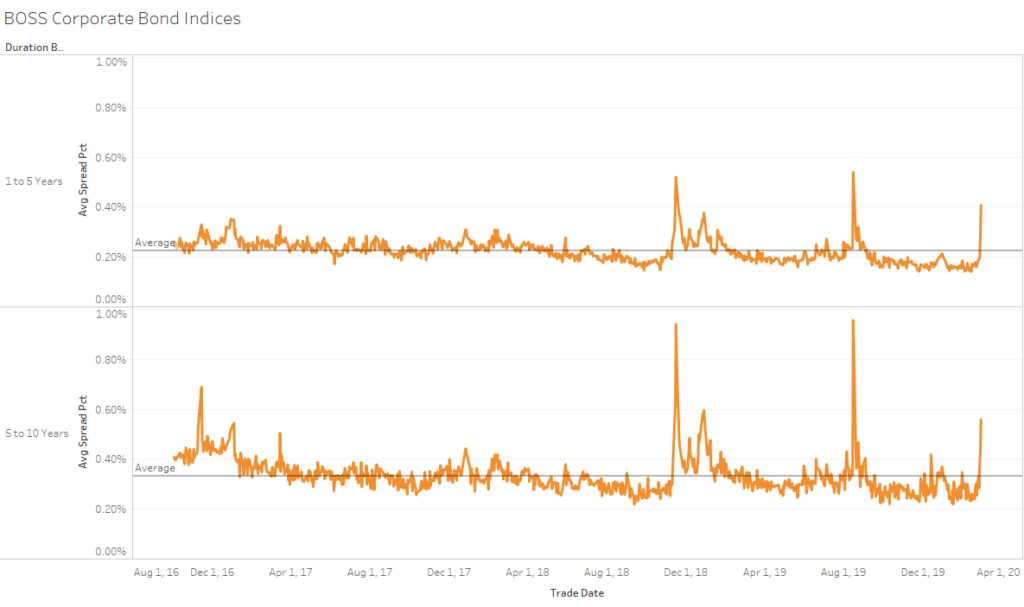

Corporate Bond Liquidity Cost Rising

As can be seen below, the cost of trading liquid, investment grade corporate bonds has spiked to nearly double its long term average for bonds with 1 to 5 years remaining to maturity, rising to 41 basis points as of February 28, 2020. The cost of trading these bonds has not quite risen to the levels seen in mid-2019 when PGE drove the cost higher with on-going forest fires in California being blamed on PGE equipment. The cost to trade 5 to 10 year bonds has also jumped to 56 basis points as of February 28, 2020.

Source: BondWave BDTI

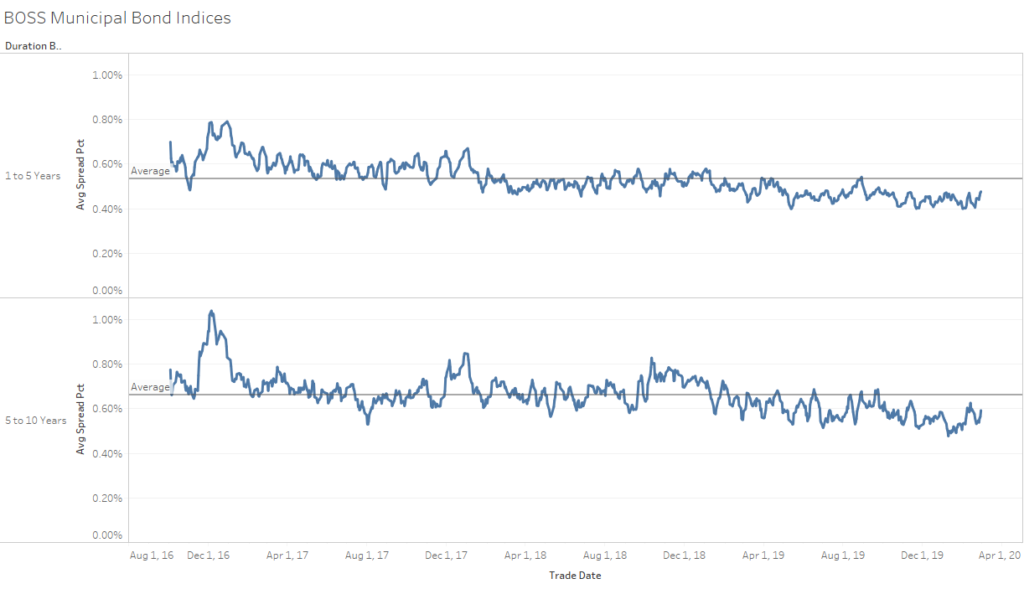

Municipal Bonds Unaffected

Meanwhile, there has been no impact on the cost of trading in the municipal bond market where bid-offer spreads remain slightly below their long-term average.

Source: BondWave BDTI