Municipal Market Dynamics

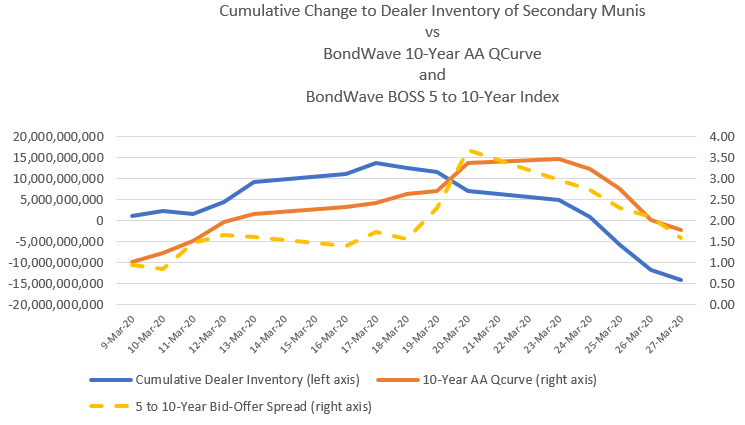

Under normal conditions municipal bond dealers are net sellers of bonds in the secondary market to their customers. Beginning March 9 conditions in the municipal market were anything but normal. As we have pointed out in previous notes (Trade Insights Vol. 9) large institutions began liquidating positions during the week of March 9 leading to inventory buildup among dealers. On a lagged basis, this led to higher yields as prices moved lower and higher trading costs as bid-offer spreads widened.

The below chart illustrates this dynamic.

Source: BondWave BDTI, MSRB

As dealers have become net sellers of bonds to their customers in the secondary market, both yields and bid-offer spreads have moved toward normal conditions on a lagged basis. However, conditions in the municipal market need to improve further before we return to previously seen yields or trading costs.