Fixed Income Market Reaction to Equity Market Selloff

With concern about the impact to economic activity of the COVID-19 virus being blamed for the recent steep selloff in equities, we are also seeing an impact on the cost of trading liquid, investment grade corporate bonds. The BondWave Benchmark Data and Trading Indices includes two corporate bond bid-offer spread indices. The BondWave Bid-Offer Spread Service (BOSS) measures the width of the bid-offer spread in the dealer-to-dealer market for A and BBB rated corporate bonds as well as the bid-offer spread in the dealer-to-dealer market for AA and A municipal bonds.

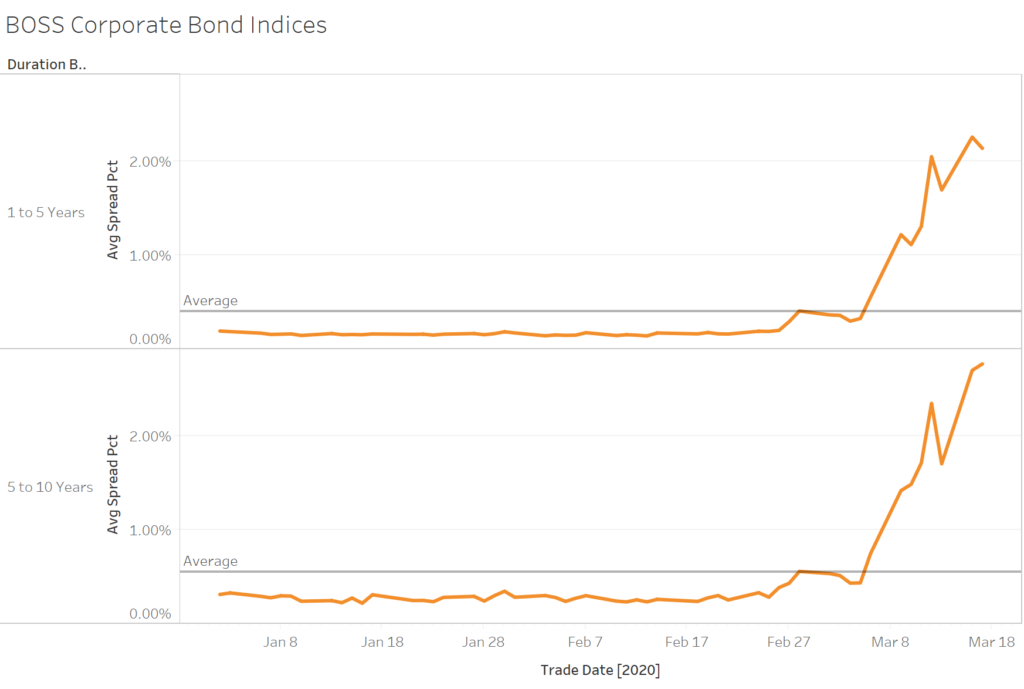

Corporate Bond Liquidity Cost Rising to New Highs

Corporate bond bid-offer spreads keep moving higher. With quarantines becoming the new normal, the cost of liquidity in the fixed income market has hit new highs. The BOSS 1 to 5 Year Corporate Index hit 2.14% on 3/17/2020 while the BOSS 5 to 10 Year Corporate Index hit 2.77%. Under normal market conditions corporate bonds have a narrower bid-offer spread than municipal bonds. As of Tuesday, corporate bond bid-offer spreads continue to outpace municipal bond bid-offer spreads by a wide margin.

It is important to note there is measurement bias at work in the data too. Many municipal bond traders report an inability to find bids for their bonds. The BOSS Index is created from reported trades. A bond that fails to trade would not be reflected in this data. So, it is possible that the index can understate the “true” spread faced by a trader. It is also possible to overstate the true spread on the corporate index if bonds that are more effected by events trade more often (airlines, energy, etc.).

Source: BondWave BDTI

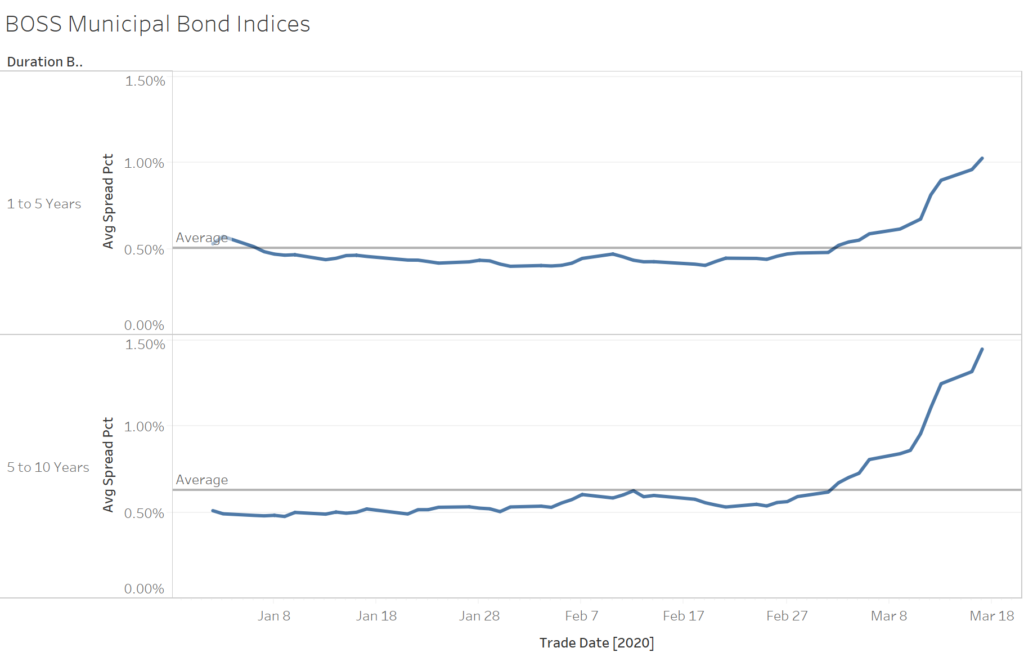

Municipal Bonds Hit New Highs

Municipal bond bid-offer spreads moved to the highest levels recorded by the BOSS Indices (dating back to April 2016). The BOSS 1 to 5 Year Muni Index rose to 1.03% on Tuesday. Meanwhile, the BOSS 5 to 10 Year Muni Index rose to 1.45%.

Source: BondWave BDTI