Developed to help bond market participants better understand trading trends in the fixed income markets, BondWave’s Data Lab has released its QMarksTM dashboards for the first quarter of 2025.

QMarks is a proprietary BondWave data set that powers its quarterly dashboards to cover all disseminated bond transactions using the regulatory-prescribed Prevailing Market Price methodology for corporate, municipal, agency, and 144A. QMarks belongs to a suite of other BondWave proprietary data sets, including QCurves, QTrades, and QScores.

Q1 2025 Observations:

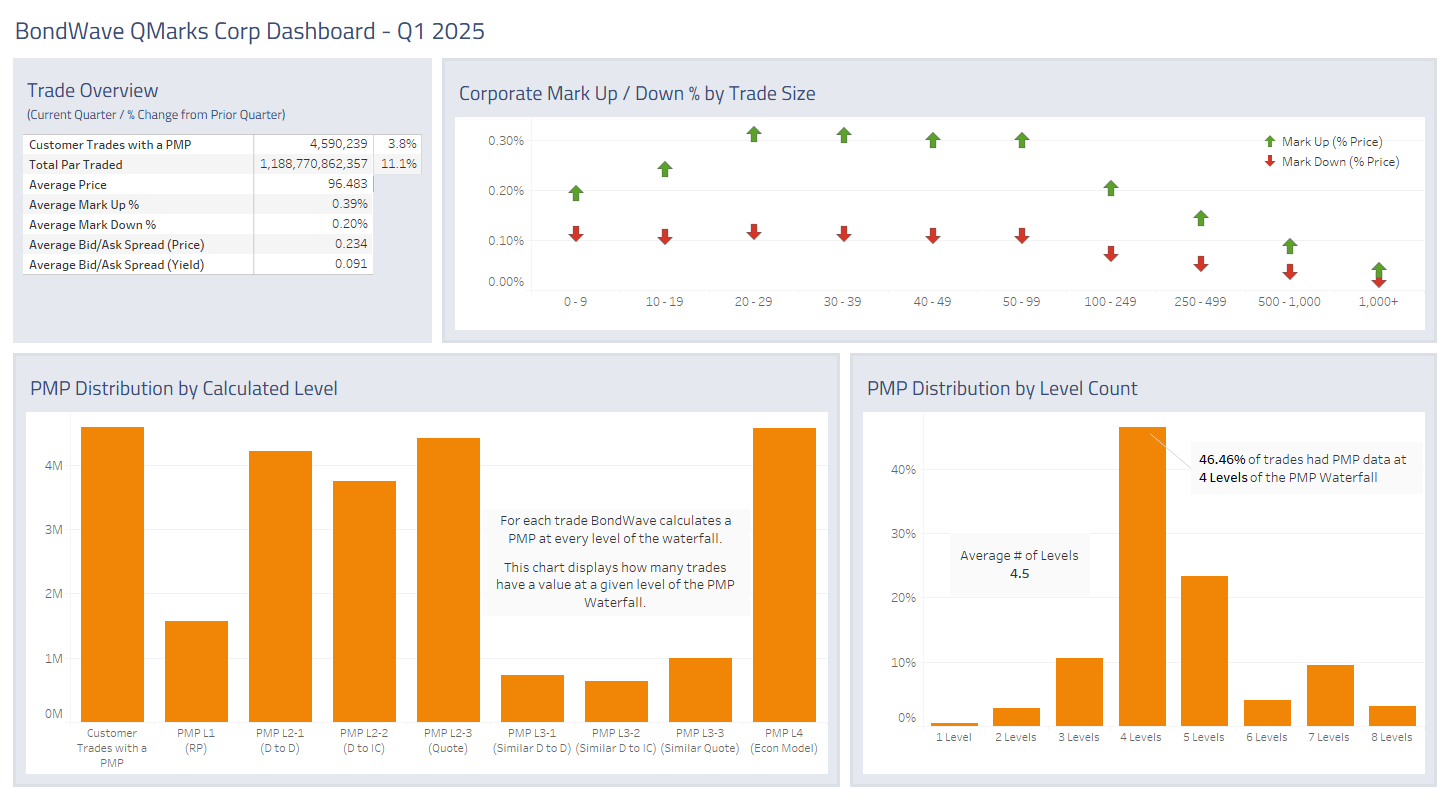

Corporate Bond Market Trends

Source: BondWave QMarks

- Corporate bond trading in Q1 2025 was very strong.

- Customer trade counts increased by 3.8% over Q4 2024, the previous highest quarter.

- Customer par traded jumped 11.1% to a new quarterly record, surpassing Q1 2024 by 5.9%.

- Mark ups, mark downs, and bid/ask spreads were unchanged.*

*During the first week of April bid/ask spreads were significantly higher.

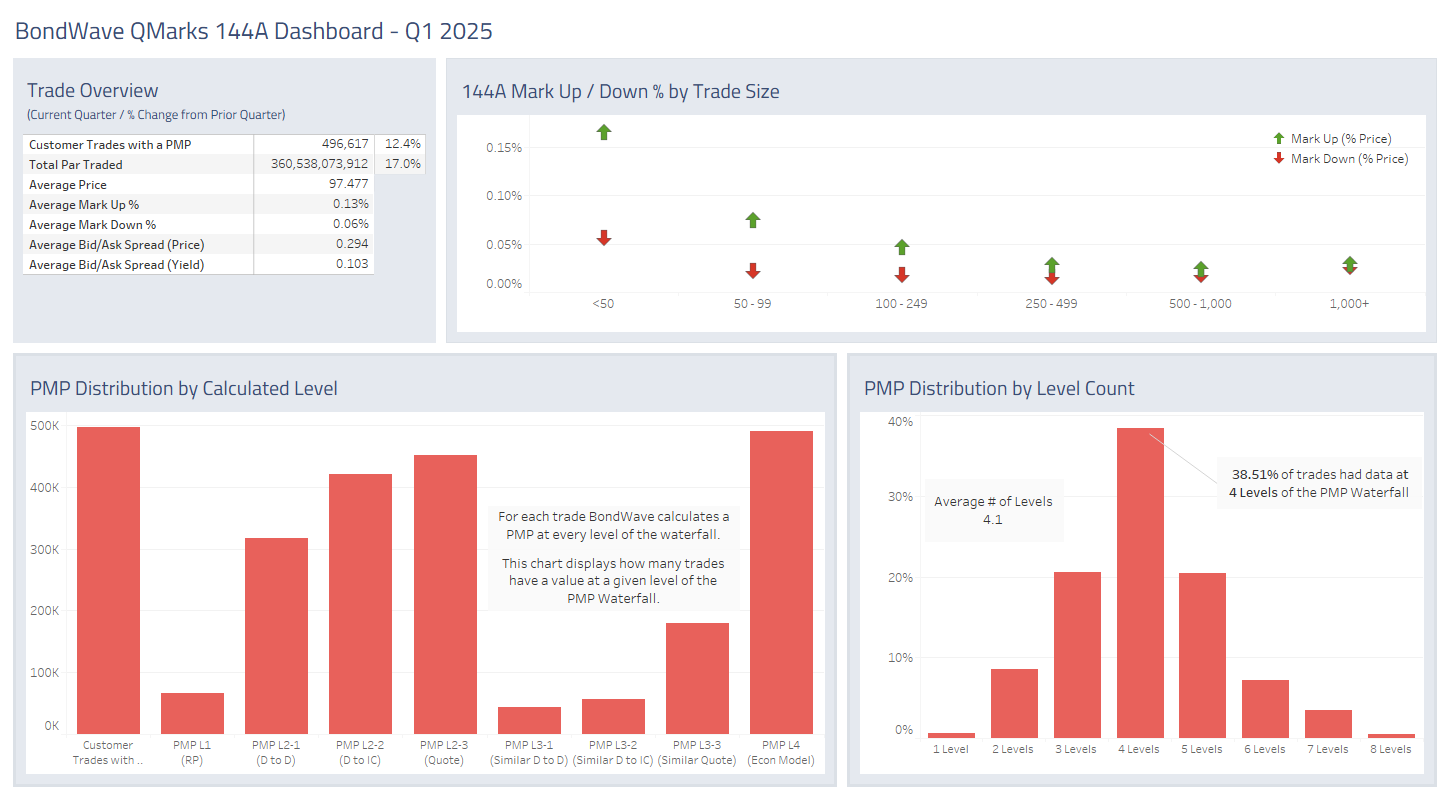

144A Bond Market Trends

Source: BondWave QMarks

- Like registered corporate bonds, 144A bonds saw significant volume growth in Q1.

- Customer trade counts were +12.4% relative to Q4 2024.

- Customer par traded was +17.0% relative to Q4 2024.

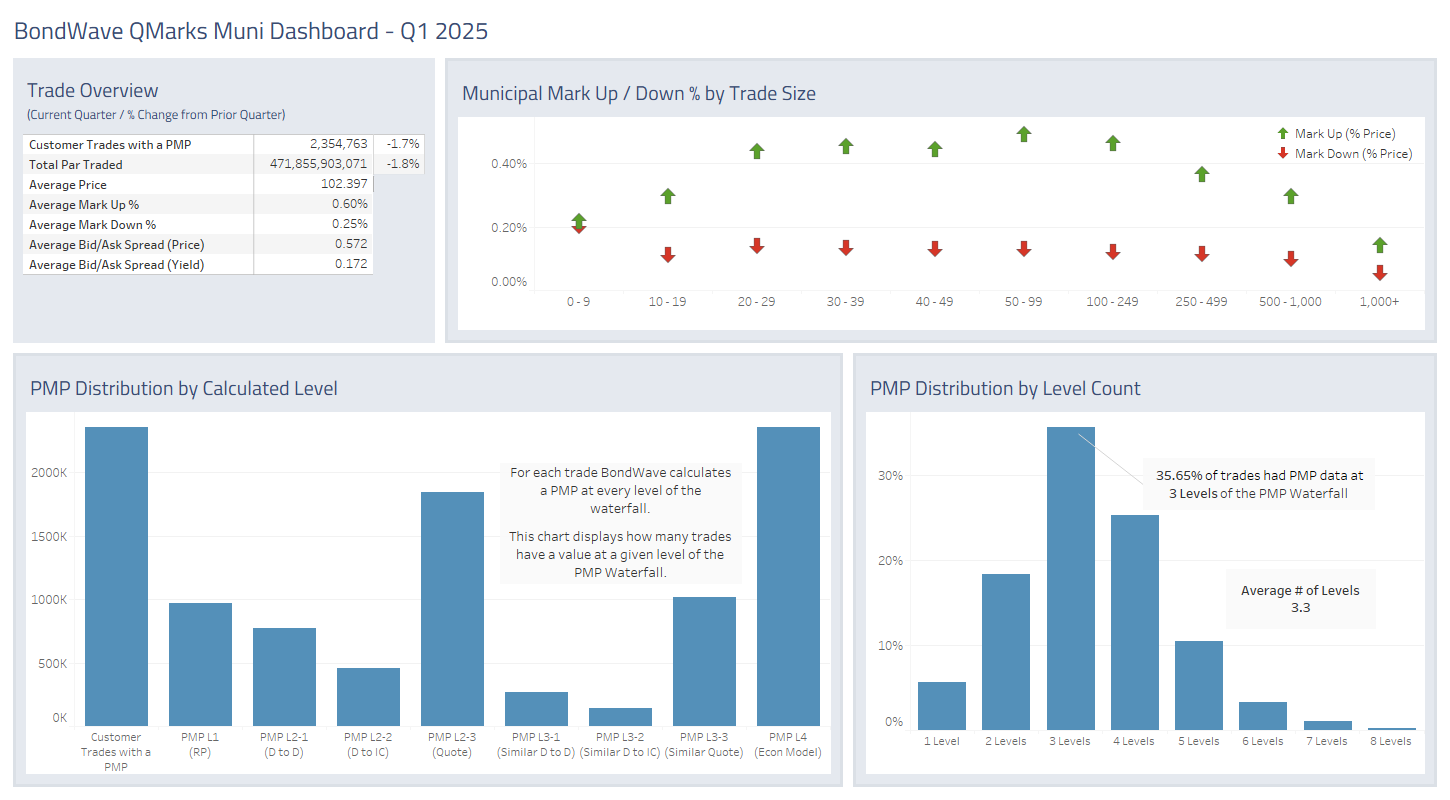

Municipal Bond Market Trends

Source: BondWave QMarks

- After strong volumes to finish out 2024, municipal trading took a slight breather.

- Customer trade counts in Q1 2025 were -1.7% relative to Q4 2024.

- Customer par traded in Q1 2025 was -1.8% relative to Q4 2024.

- Mark ups, mark downs, and bid/ask spreads were stable.*

*During the first week of April bid/ask spreads were significantly higher.

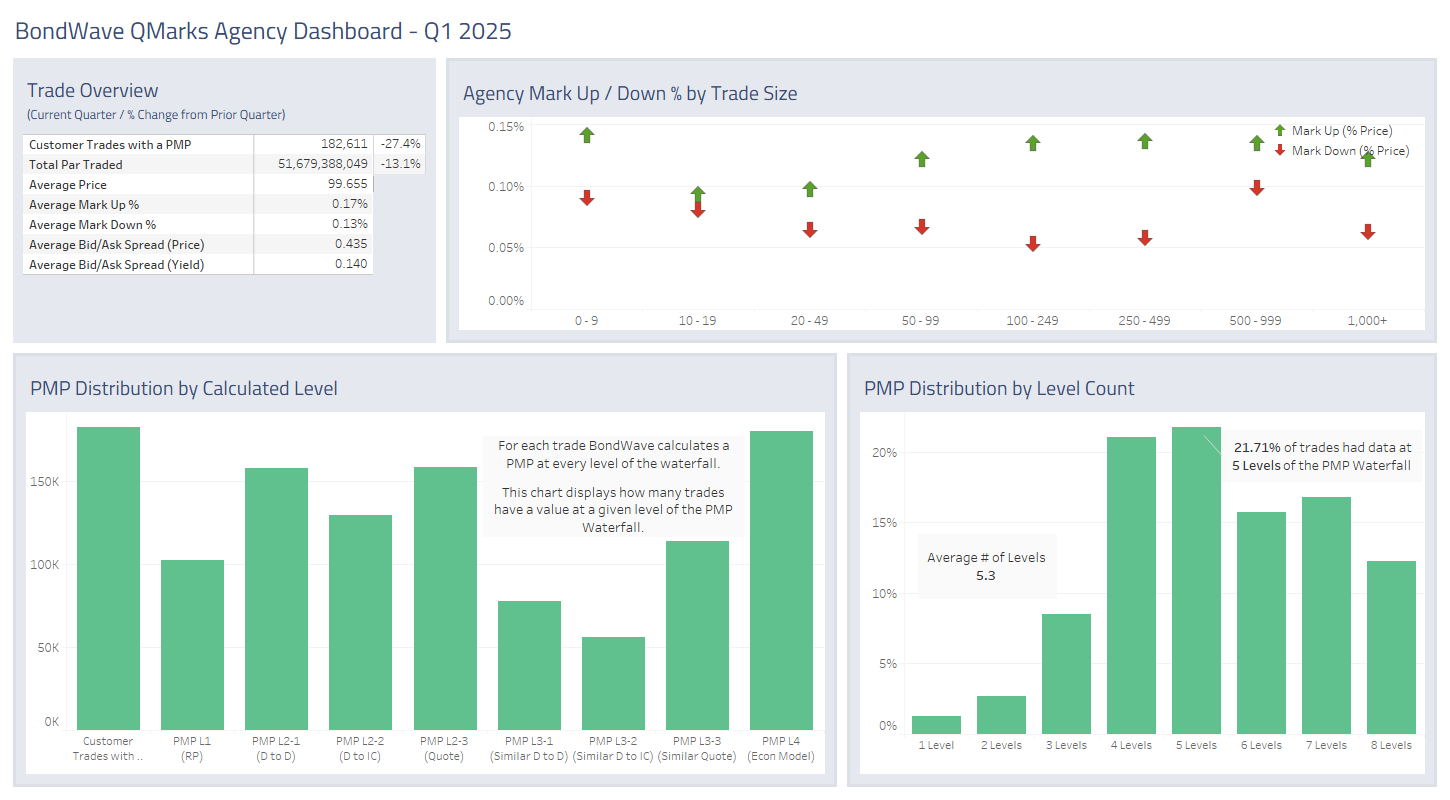

Agency Bond Market Trends

Source: BondWave QMarks

- Agency trading volume decreased significantly in Q1 2025.

- Customer trade counts were -27.4% relative to Q4 2024.

- Customer par traded was -13.1% relative to Q4 2024.

The dashboards for the previous quarters referenced above are located here:

Last quarter: Q4 2024 Dashboards

Year-over-year: Q1 2024 Dashboards