Developed to help bond market participants better understand trading trends in the fixed income markets, BondWave’s Data Lab has released its QMarksTM dashboards for the fourth quarter of 2024.

QMarks is a proprietary BondWave data set that powers its quarterly dashboards to cover all disseminated bond transactions using the regulatory-prescribed Prevailing Market Price methodology for corporate, municipal, agency, and 144A. QMarks belongs to a suite of other BondWave proprietary data sets, including QCurves, QTrades, and QScores.

Q4 2024 Observations:

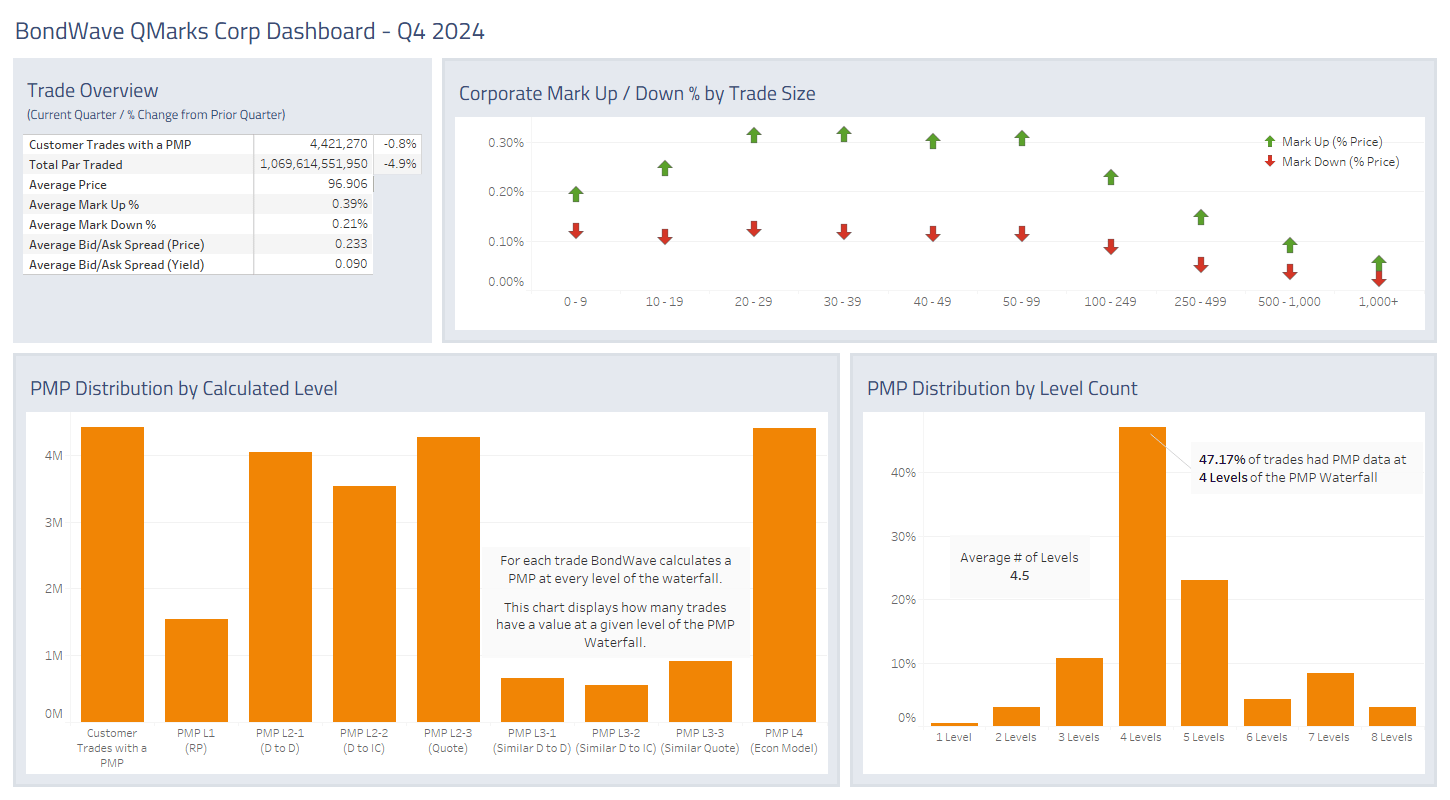

Corporate Bond Market Trends

Source: BondWave QMarks

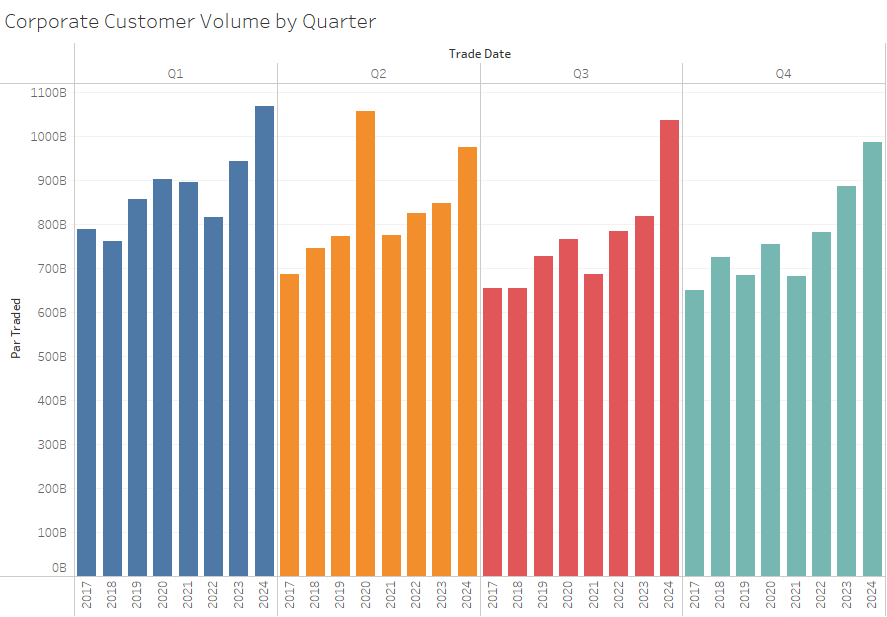

- While total par traded for corporate bonds shrank 4.9% quarter-over-quarter, it remained strong on a year-over-year basis.

- All four quarters saw growth in trading over the prior year resulting in record trading volume for 2024.

Source: BondWave QMarks

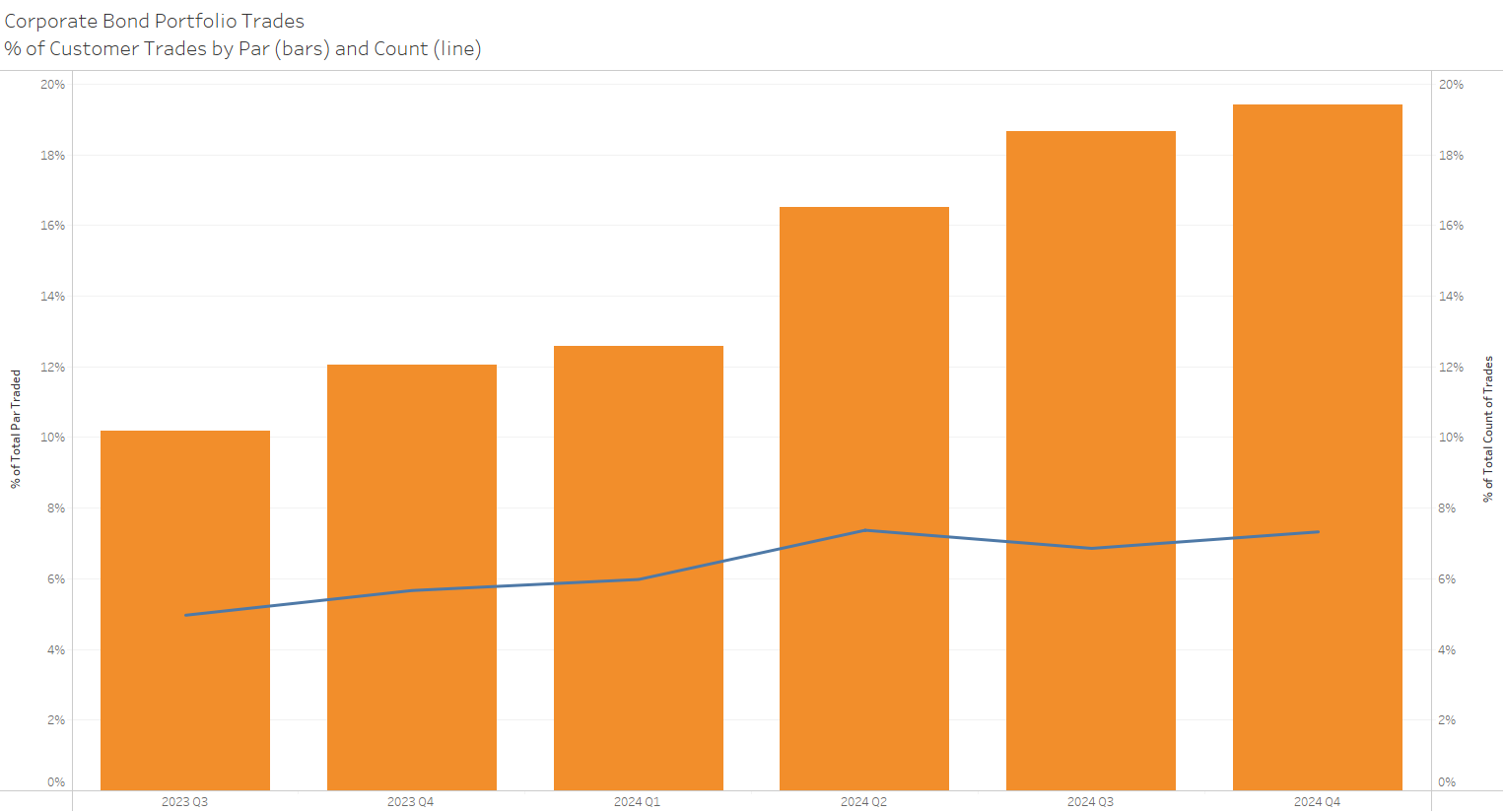

- Portfolio trading continues to grow in importance on both a quarter-over-quarter basis and a year-over-year basis. In a year’s time portfolio trading has grown from 12% to 19% of customer trading. Because overall trading volumes have grown in that time, portfolio trading has grown 78.6% on a notional basis.

Source: BondWave QMarks

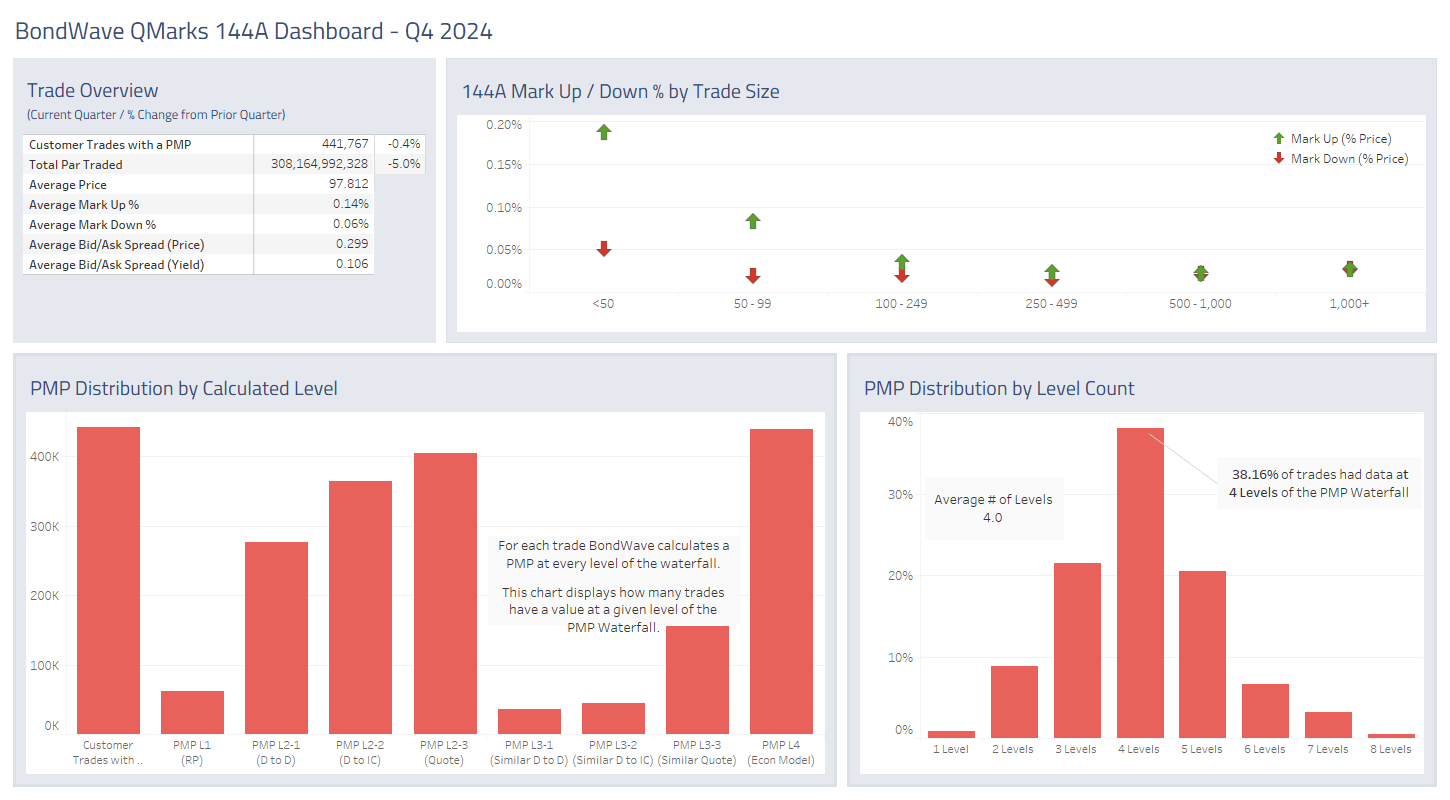

144A Bond Market Trends

Source: BondWave QMarks

- 144A volume did not keep pace with listed corporate bonds. Total par traded for the quarter shrank 5% while the number of trades shrank a more modest 0.4%.

- Mark-ups and mark-downs held rock steady at 14 bps and 6 bps, respectively.

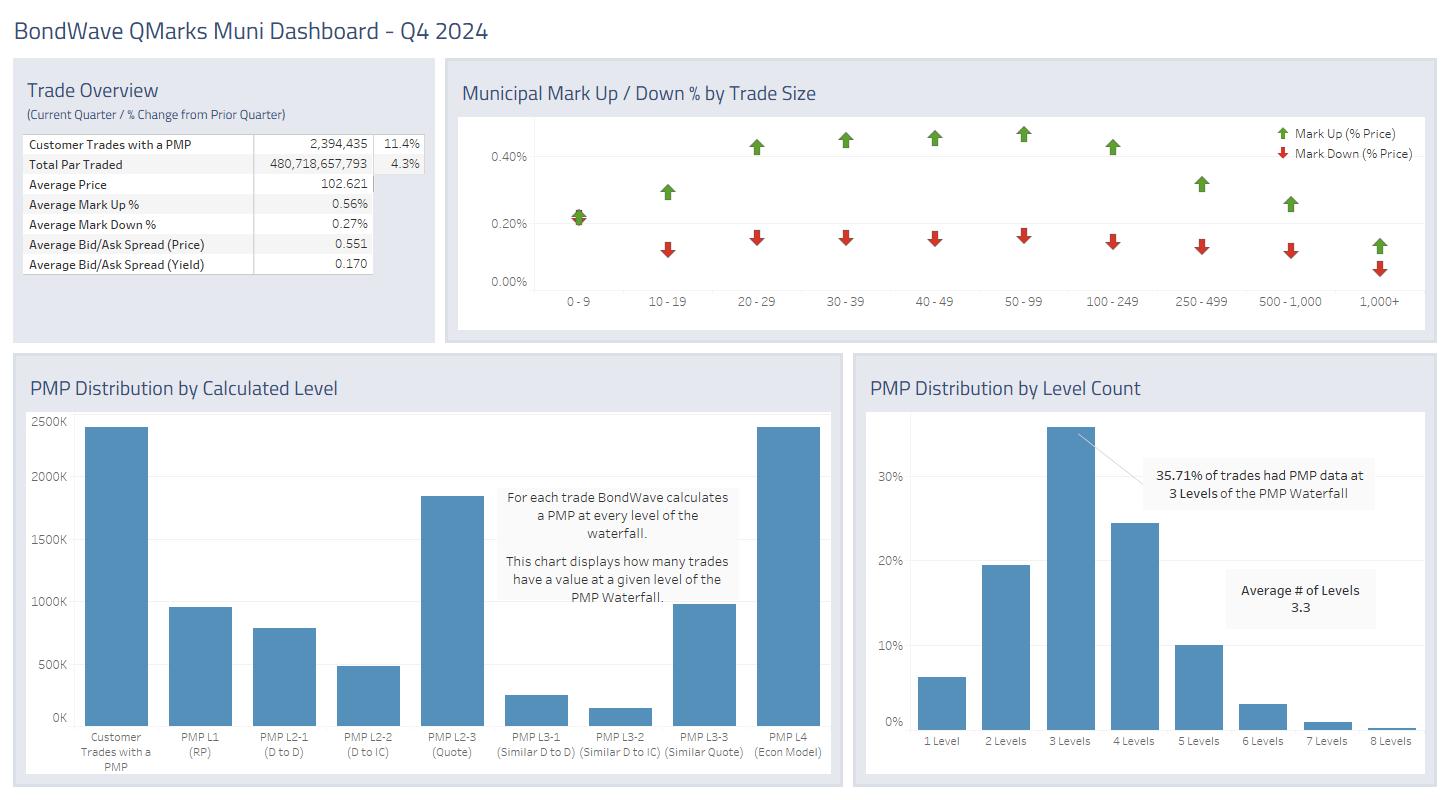

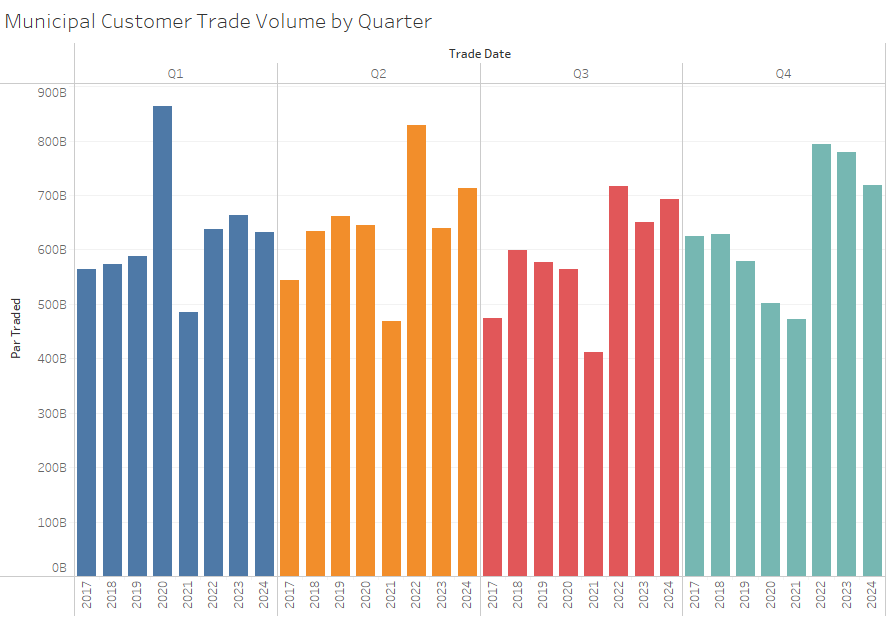

Municipal Bond Market Trends

Source: BondWave QMarks

- Municipal trading rose 4.3% for the quarter and 0.9% for the year. Par value traded in 2024 still trails records set in 2022 by 7.4%.

- However, the new administration is discussing the removal of municipal bond tax exemption. If that occurs, 2025 volumes are likely to be at record levels.

Source: BondWave QMarks

- Municipal bond mark-ups decreased slightly in the fourth quarter. From an average of 61 basis points in Q3, mark-ups came down to an average of 56 basis points in Q4.

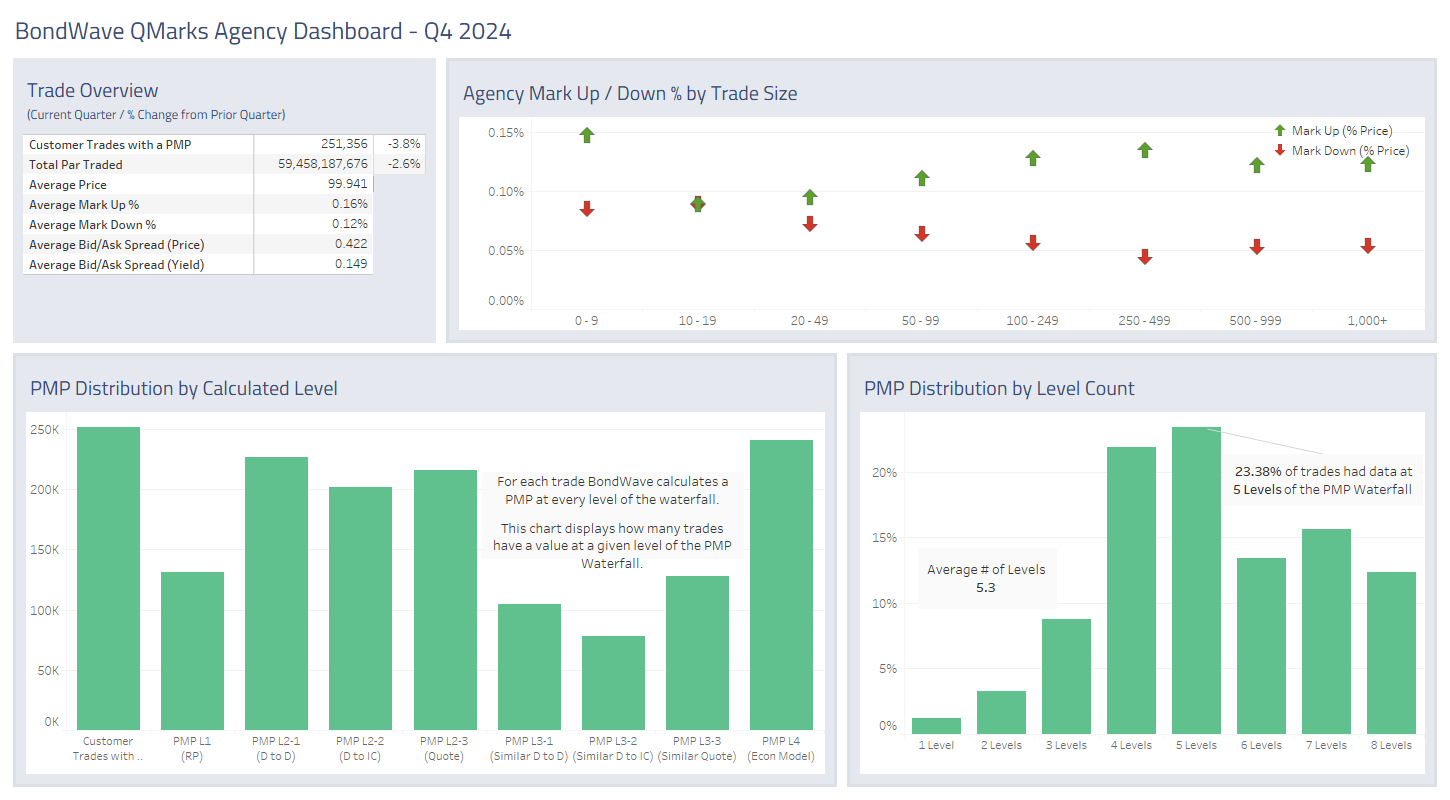

Agency Bond Market Trends

Source: BondWave QMarks

- Agency trading volume in the fourth quarter was down. Total par traded for the quarter shrank 2.6% while the number of trades shrank a more modest 3.8%.

- The decreased volumes had almost no impact on mark-ups and mark-downs.

Dashboards for the previous quarters referenced above are located here:

Last quarter: Q3 2024 Dashboards