Trade Insights – Volume 24

The Close, The Close, The Close

Equity market indexation has pushed increasingly more volume to the close. Nearly 15% of the daily NYSE volume is printed at that single price every day. And when the day coincides with a quarterly derivatives expiration the average daily volume on the close jumps to 27%.

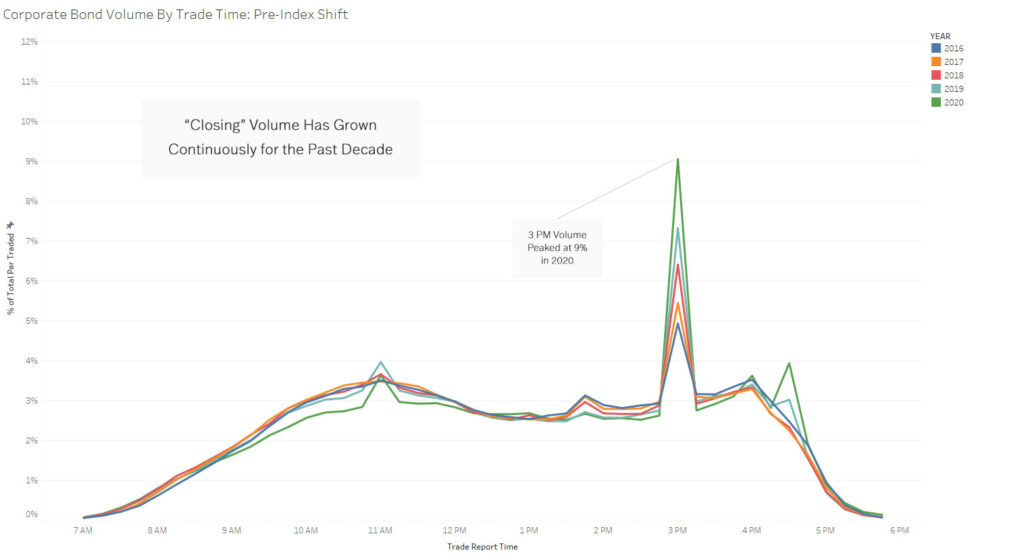

A similar shift has been occurring in the corporate bond market over the last decade. In 2016, 4.9% of corporate bond customer daily volume was printed in the 15 minutes[1] between 3:00 PM and 3:15 PM Eastern (3:00 PM window), the most of any 15-minute window throughout the day. That volume grew each year until 2020 when it reached a high of 9.1% of daily volume.

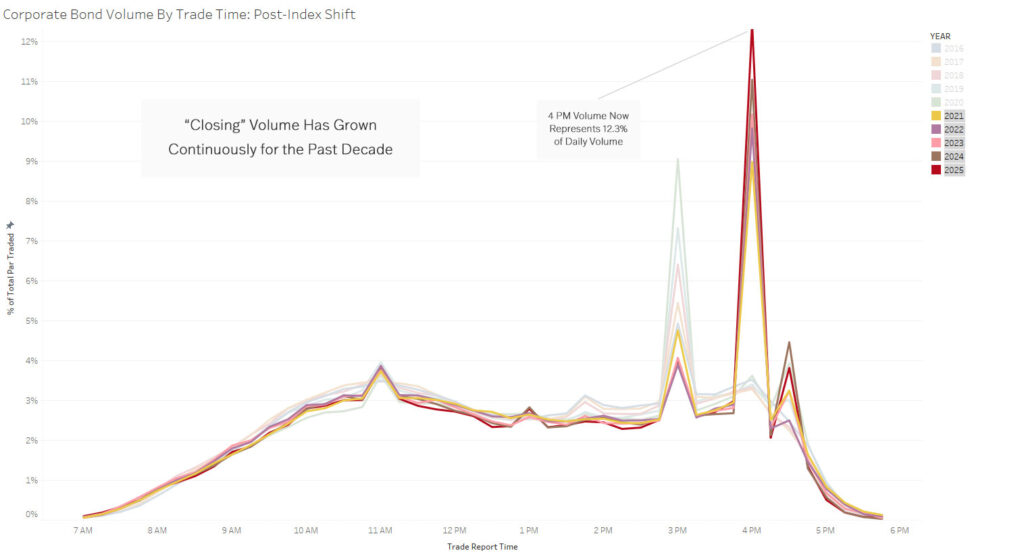

But then a significant event occurred. In early 2021 Bloomberg Barclays announced a change to the time it prices their US dollar denominated indexes from 3:00 PM Eastern to 4:00 PM Eastern. With that change volume immediately shifted to an hour later with the 4:00 PM to 4:15 PM Eastern window (4:00 PM window) taking over the lead in 2021 at 9.0% of daily volume, while the 3:00 PM window fell back to 4.8% of daily volume.

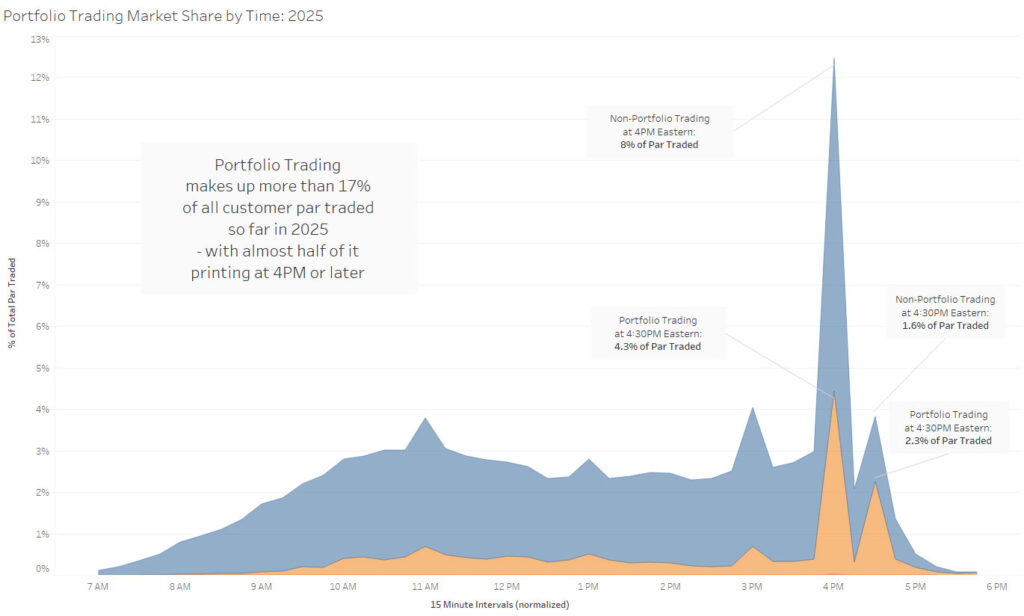

Like the 3:00 PM window before it, the 4:00 PM window has grown every year since it took over the lead in 2021. That growth comes from a second contributing factor. The growth in portfolio trading has pushed volume in the 4:00 PM window to 12.3% of daily volume so far in 2025.

Printed? Or Traded?

Using the word “printed” instead of “traded” up to this point was intentional. The major difference between equity trading at the close and fixed income trading at the close is that equity trades all print at the same price, while in fixed income they do not. Market participants determine a single clearing price for equities and print it at 4:00 PM. In fixed income that is not the case. Throughout the day, traders negotiate fixed income trades on a spread-to-treasury basis. They print those trades at or around 4:00 PM, applying the appropriate treasury fixing plus the pre-negotiated spread(s). Traders may reach agreement on the spread at any point during the day, but they delay printing the trade until the 4:00 PM treasury price becomes available. This process blends multiple trading moments, making the “trade time” of a fixed income transaction an amalgam of several discrete times.

For any fixed income trade the price can be thought of as comprising two elements: the benchmark treasury price, plus some factor (the spread) that accounts for every way in which the bond differs from a treasury. By negotiating prices on a spread-to-treasury basis throughout the day and then pricing based on the 4:00 PM treasury price, at least one of those two elements is neutralized for all traders who have their trades printed at 4:00 PM.

As a result, from a trade cost perspective, the market timing of executing the treasury element is isolated from the effectiveness of negotiating the spread for trades executed in this manner.

Equitization?

On the surface the migration of volume to “the close” looks like the further equitization of the fixed income market. And to some extent it is, as indexation and comparisons to benchmarks has driven trading behavior in the equity market, those forces appear to be driving behavior in the corporate bond market. But there are also significant differences. There is still a distinctly fixed income flair to the volume migration. There is no single market clearing price, and for various reasons there is not even a single market clearing time of trade.

ABOUT BONDWAVE LLC

Established in 2001, BondWave® is a financial technology firm specializing in fixed income solutions designed to enable clients to manage and expand their fixed income business with greater efficiency. We serve a wide range of clients, including traders, compliance professionals, RIAs, and asset managers, who use our tools to provide a superior fixed income experience to their clients while supporting critical regulatory mandates and optimizing workflows.

Effi®, our Engine for Fixed Income, is the single platform through which we deliver all our solutions – providing intuitive dashboards and insights into every fixed income position and transaction to drive informed investment and business decisions. Effi’s capabilities include Portfolio Oversight, Trade Oversight, and curated Muni News. Our solutions are fueled by proprietary data sets that are developed using AI, machine learning technologies, and advanced data science.

This material has been prepared by BondWave LLC (BondWave) and reflects the current opinion of the authors. It is based on sources and data believed to be accurate and reliable but has not been independently verified by BondWave. Opinions and forward-looking statements are subject to change without notice. The material does not constitute a research report or advice and any securities referenced are for illustrative purposes only and not a recommendation to buy or sell any security.

[1] Fixed income dealers have 15 minutes to report trades to the tape.