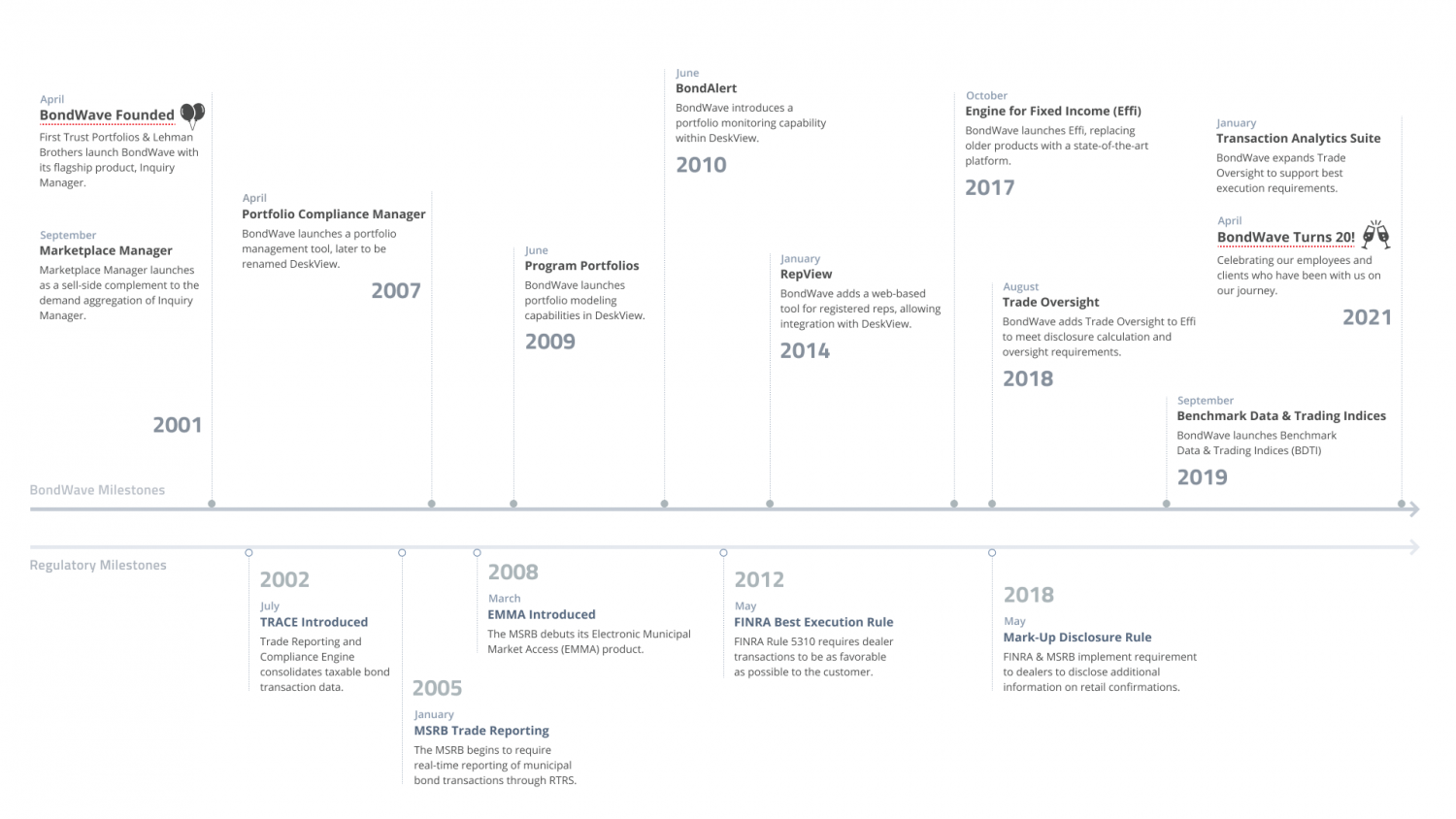

Reflecting on BondWave’s 20-year anniversary and the evolution of fixed income markets during that period, it is remarkable to think about some of the industry’s most notable milestones and the role BondWave played in helping bond market professionals adapt and the entire industry evolve. From my perspective, the three major forces of change on the bond markets were the convergence of data, the emergence of new technologies and stronger market regulation. During my 25-year career in fintech, these three core pillars have combined to form a much more automated and far more efficient bond marketplace resulting in increased transparency and innovation.

BondWave and Regulatory Milestones

2001 – 2011

Looking back to 2001, a significant number of electronic trading venues had launched in the late 1990s, which subsequently contracted by market forces to just a surviving few in the early 2000s. These surviving few became the sparks that began the electronification of the fixed income markets. Instead of picking up phones after perusing the “blue list” and faxes of dealer inventories, traders and advisors were empowered to access liquidity by transacting electronically. Subsequently, the introduction of FINRA’s TRACE corporate transaction data in 2002 began the trend of enhanced price transparency, which then expanded with the MSRB’s RTRS municipal transaction data feed in 2005 and EMMA in 2008. This increased transparency and broader access to data for all market participants, coupled with new technologies, was what truly provided the foundation for innovation.

Was it the chicken or the egg? Did the changing regulatory force increased transparency or vice versa? Both factors led BondWave to innovate and tailor our solutions accordingly over the years. In the latter half of the 2000s, BondWave’s Portfolio Analytics platform was enhanced to support regulatory and fiduciary workflows, which allowed wealth management firms to monitor and manage custom bond portfolios more efficiently. From 2007 through 2010, we introduced Portfolio Compliance Manager, Program Portfolios and BondAlert, combining our solutions to provide clients with a singular view into every fixed income position enterprise wide.

2011 – 2021

In 2016, BondWave embarked on the development of our engine for fixed income, Effi™, a new technology platform that consolidated our portfolio analytics capabilities into a flexible, intuitive and customizable user interface. At the same time, the BondWave Lab began to apply machine learning and advanced data science to FINRA and MSRB trade data, developing proprietary data sets and providing the foundation for BondWave’s Transaction Analytics suite. The FINRA best execution rule introduced in 2012, combined with the FINRA and MSRB mark-up disclosure rule in 2018, further complicated traditional approaches to fair pricing, mark-up and best execution. Leveraging the regulatory prescribed “waterfall” methodology, we responded by creating a transaction benchmarking engine – a virtual one-stop shop for pre- and post-trade fair pricing, mark-up and best execution. With this, Effi™ had evolved to provide a single platform utilizing advanced analytics and workflows for every fixed income position and transaction, regardless of custody provider or execution venue.

2021 and Beyond

Looking ahead, the increased availability of alternative data and emergence of advanced technologies will provide the foundation for the next wave of innovation. More regulation and greater levels of market transparency will lead us to continue to evolve our solutions. As bond markets move to more closely resemble the transparency and open structure of the equity markets, trading costs will continue to be scrutinized and the need for even better pre- and post-trade analysis will be critical. As the fixed income markets gain more scrutiny perhaps a Reg NMS for bonds emerges driven by the enhanced availability of pre-trade market data? From this assessment, it’s clear that a complete view of every fixed income position and transaction has never been more important than it is currently.

One thing is certain, BondWave will continue to be laser-focused on our clients and adapt to a changing marketplace with simple yet sophisticated solutions to help address any new regulatory requirements or market challenges that may arise. Happy Anniversary, BondWave! I cannot wait to see what the next 20 years has in store for us.