Developed to help bond market participants better understand trading trends in the fixed income markets, BondWave’s Data Lab has released its QMarksTM dashboards for the fourth quarter of 2022.

QMarks is a proprietary BondWave data set that powers its quarterly dashboards to cover all disseminated bond transactions using the regulatory-prescribed Prevailing Market Price methodology for corporate, municipal, agency, and 144A. QMarks belongs to a suite of other BondWave proprietary data sets, including QCurves, QTrades, and QScores.

Q4 2022 Observations:

“With growing trading volume, smaller average trade sizes, and wider bid/offer spreads, it is tempting to assume that higher yields in 2022 have resulted in a shift toward greater activity from retail clients.” – Paul Daley, Managing Director

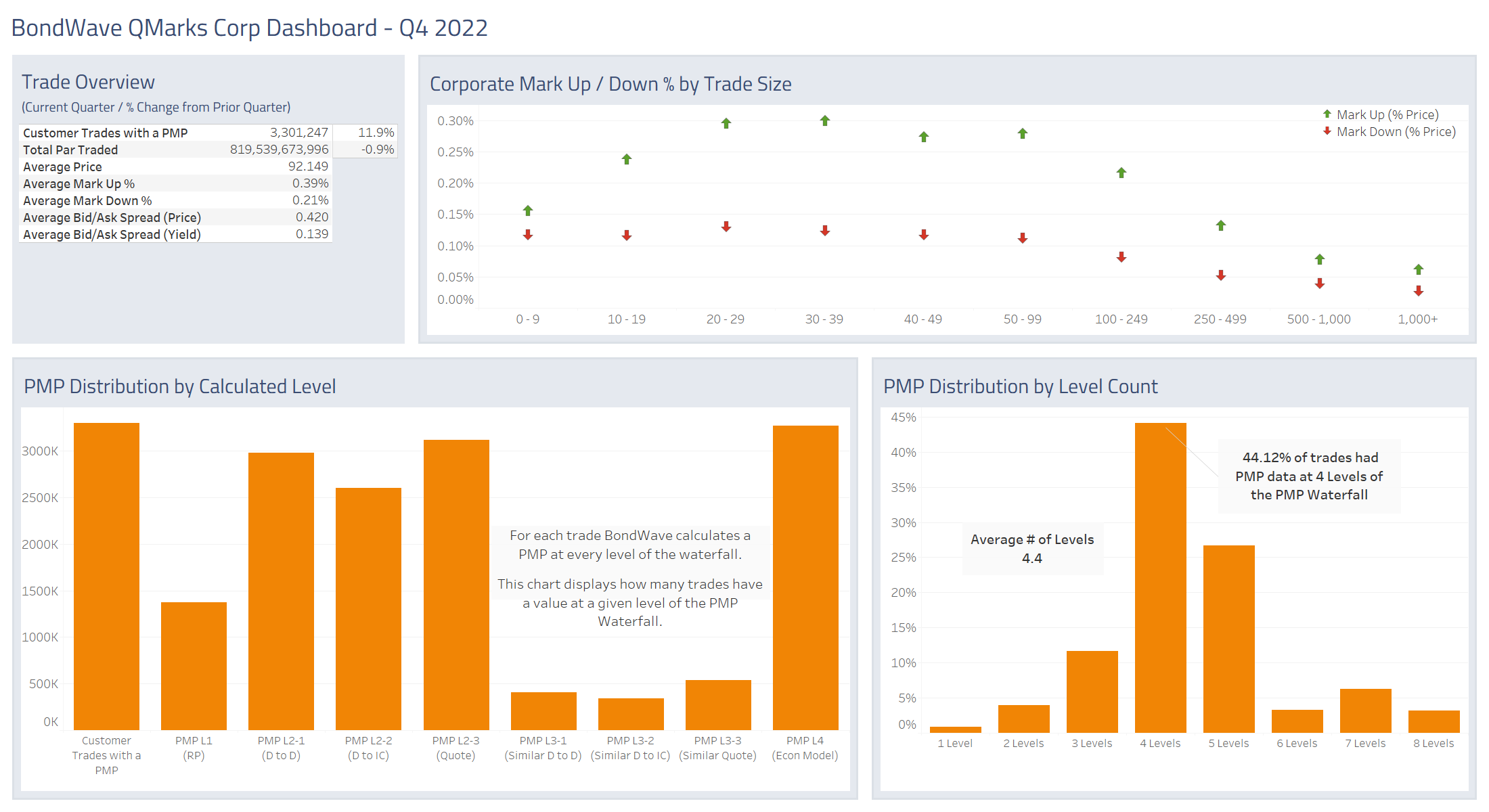

Corporate Bond Market Trends

Observations:

- With a return to meaningful yields in 2022, corporate bond par traded by clients increased by 14.9% year-over-year, though Q4 volume was down slightly vs. Q3 (-0.9%).

- At the same time, the average par per trade was down significantly year-over-year (-34%, $375,000 in Q4 2021 vs. $248,000 in Q4 2022).

- With higher yields came higher trading costs as bid/ask spreads jumped 29% year-over-year, from $0.325 to $0.420.

Source: BondWave QMarks

Municipal Bond Market Trends

Observations:

- Municipal bonds saw significant growth in trading volume in Q4 vs. Q3 (+13.5%) and massive growth vs. Q4 2021 (+75.4%).

- Average trade size shrunk year-over-year from $238,000 to $273,000 (-12.7%), but the growth in the number of trades more than compensated for the smaller trade sizes.

- At the same time, bid/ask spreads were up 10% year-over-year.

Source: BondWave QMarks

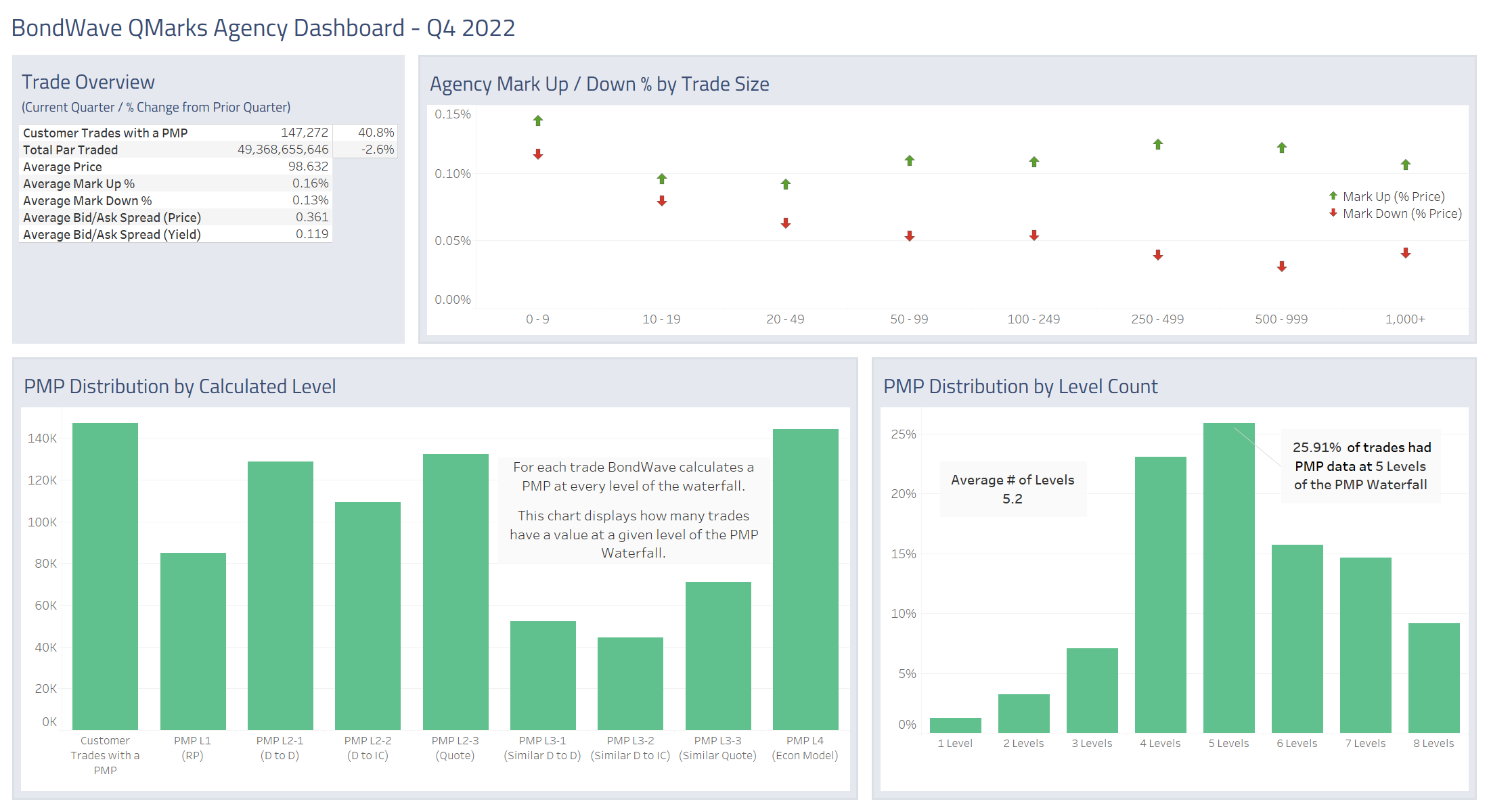

Agency Bond Market Trends

Observations:

- Agency bonds were the only group that failed to see year-over-year trading growth. With Q4 2022 volume lower than Q3 2022 (-2.6%), it also trailed Q4 2021 volume (-5.9%).

- The average trade size for agency bonds was down significantly year-over-year (-66.2%, $335,000 vs. $992,000).

- Bid/ask spreads jumped a rather significant 44% year-over-year, from $0.250 to $0.361.

Source: BondWave QMarks

144A Bond Market Trends

Observations:

- 144A bonds saw more modest growth in trading volumes. Q4 2022 par traded by clients was +2.4% vs. Q3 2022 and +3.0% vs. Q4 2021.

- The average trade size was down year-over-year too (-14%, $689,000 vs $799,000).

- Bid/ask spreads jumped a whopping 59% year-over-year, from $0.300 to $0.478.

Source: BondWave QMarks

The dashboards for previous quarters referenced above are located here: