BondWave, a leading financial technology firm servicing the fixed income market, has calculated up to eight pricing benchmarks for every customer trade disseminated by FINRA and the MSRB for asset classes requiring mark-up disclosure dating back to 2018. This Universal PMP data set is part of BondWave’s Benchmark Data & Trading Indices (BDTI), now known as QMarksTM.

Beginning with Q4 2020, BondWave will begin producing dashboards for each of the four covered asset classes (corporate, municipal, agency, and 144A bonds) with plans to expand coverage to securitized products (MBS, ABS, CMO, etc.). The dashboards will help market participants better understand trading trends in the fixed income markets.

Fourth Quarter 2020 UPMP Dashboards

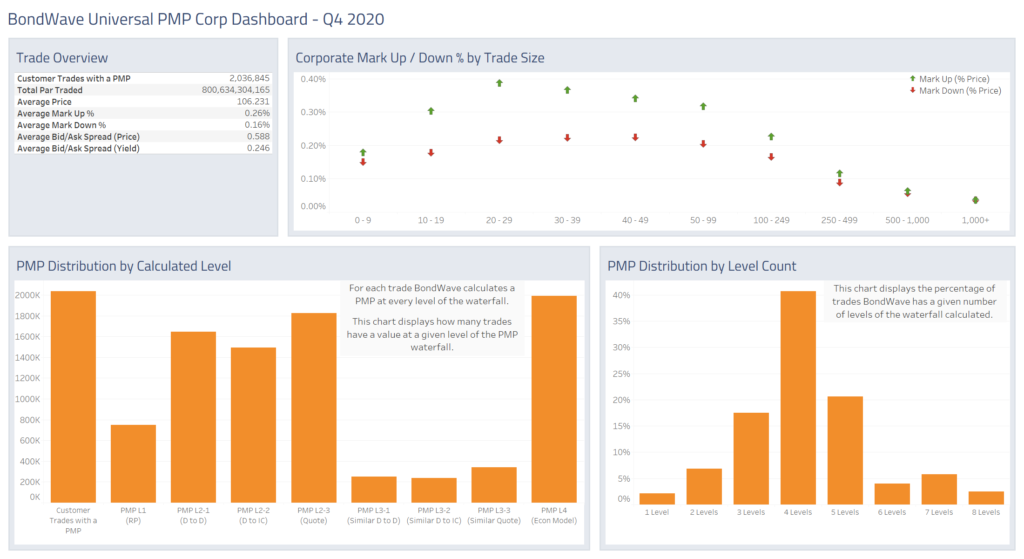

Corporate

- Corporate bond customer trading exceeded $800 billion in the fourth quarter

- Volume decreased 0.3% relative to the third quarter

- Volume decreased 26.0% from the post-stimulus highs of the second quarter

- Average mark-ups in the fourth quarter were 26 basis points

- Average mark-downs were 16 basis points

- Both those values are the lowest seen in our data

Source: BondWave BDTI

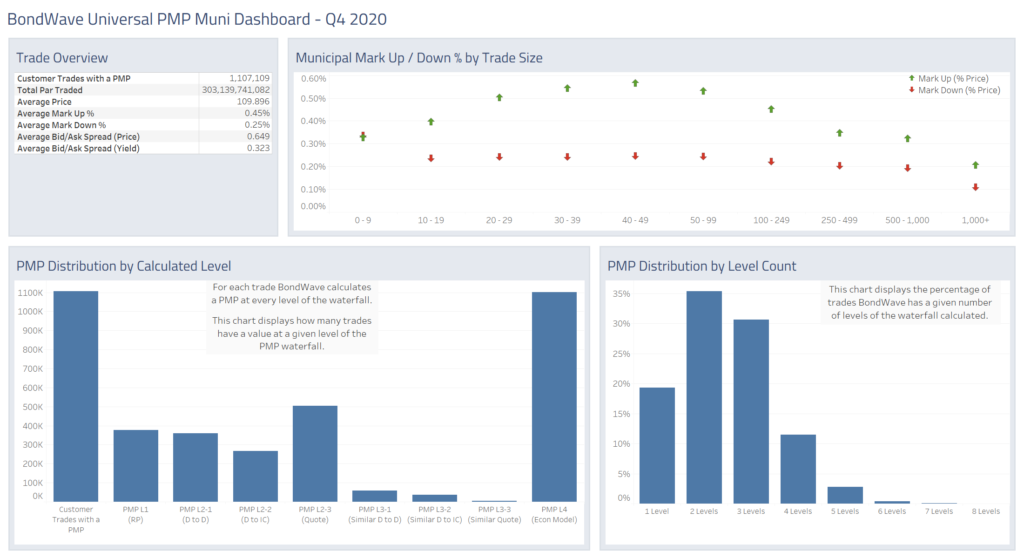

Municipal

- Municipal bond customer trading exceeded $303 billion in the fourth quarter

- Volume decreased 6.7% relative to the third quarter

- Volume decreased 40% relative to the pandemic driven sell-off of the first quarter

- Average mark-ups in the fourth quarter were 45 basis points

- The lowest level seen in our data

- Average mark-downs in the fourth quarter were 25 basis points

- The second lowest level seen in our data behind only the 24 basis points we saw in the first quarter of 2020

Source: BondWave BDTI

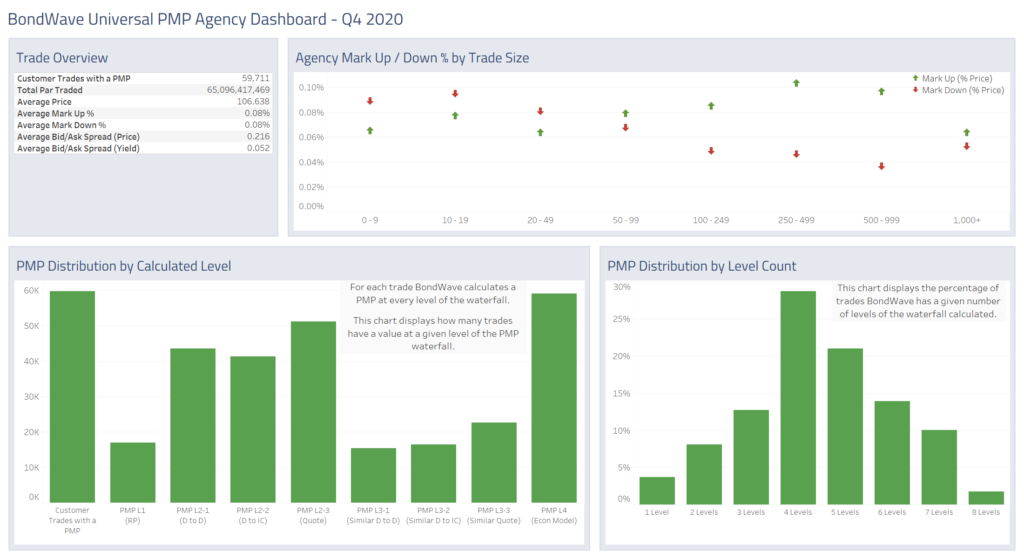

Agency

- Agency bond customer trading exceeded $65 billion in the fourth quarter

- Volume decreased 16.5% relative to the third quarter

- Volume decreased 22.2% relative to the first quarter high

- Average mark-ups in the fourth quarter were 8 basis points

- Average mark-downs were also 8 basis points

- Both those values are the lowest seen in our data

Source: BondWave BDTI

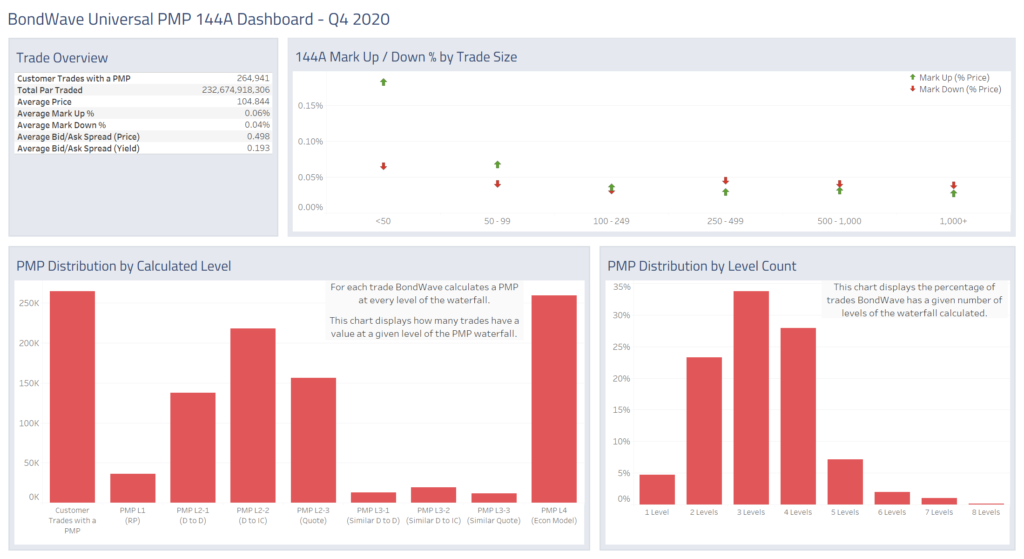

144A

- 144A bond customer trading was nearly $233 billion in the fourth quarter

- Volume increased 5.3% relative to the third quarter

- Volume decreased 10.7% relative to the second quarter high

- Average mark-ups in the fourth quarter were 6 basis points

- Average mark-downs were 4 basis points

- Both values are below the historic average

Source: BondWave BDTI