WHEATON, IL, September 16, 2019 – BondWave LLC, a leading financial technology firm focused on fixed income solutions, announced today the launch of its Benchmark Data and Trading Indices (BDTI). This suite of BondWave solutions utilizes quantitative benchmark data to enable informed, quantitative and sophisticated analytics that supports mark-up disclosure, best execution, fair pricing and transaction cost analysis. The proprietary trading indices are designed to surface trends in liquidity and help evaluate overall transaction costs.

Providing a unique view into the traditional world of fixed income, BondWave’s BDTI leverages advanced data science and extensive fixed income expertise to provide fully transparent, independent and unbiased fixed income insights. The data and indices support industry best practices for the standardization of compliance processes, supporting mark-up disclosure, best execution, fair pricing and transaction cost analysis while simultaneously providing new trading insights to further enhance business intelligence.

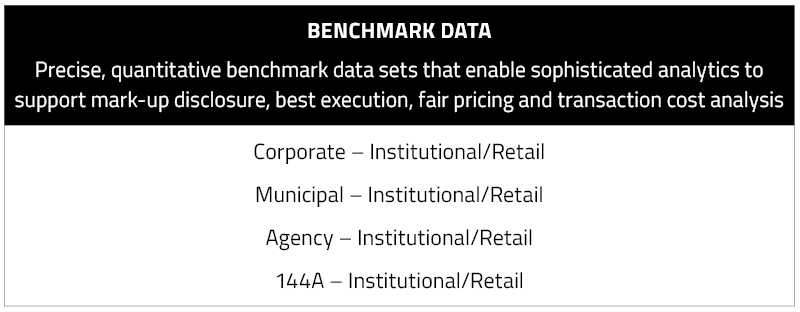

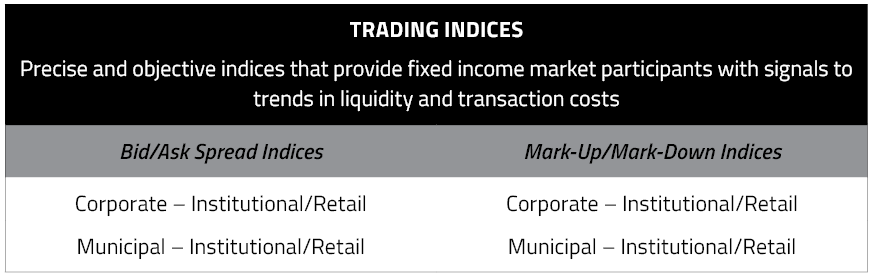

BondWave’s BDTI is powered by Effi™, its engine for fixed income, using a combination of publicly reported trades and quotes as well as proprietary data and algorithms to expose patterns in fixed income markets. These unique data sets provide a valuable perspective for fixed income traders, liaisons, advisors and compliance professionals, helping to formulate trade ideas and support compliance initiatives. BondWave’s suite of Benchmark Data and Trading Indices includes:

“The demand has never been greater for more sophisticated fixed income benchmark data that can support the regulatory requirements surrounding mark-up disclosure, best execution, and fair pricing while also helping to assess overall transaction costs,” said Michael Ruvo, CEO of BondWave. “Our application of advanced technologies to create enhanced data sets has made it possible to develop quantitative and unbiased benchmark data and trading indices for the fixed income markets. This data can be utilized to apply standardized measurements against all executions, leveraging the ‘waterfall’ methodology prescribed by the regulators, to streamline and enhance existing compliance and regulatory processes,” noted Ruvo.