The Cost of Uncertainty

Traders are asked to price financial assets all day every day. Sometimes this is easy and mechanical. Information about the asset is well understood and embedded in past prices. Past prices are very recent and very plentiful. There is a wide consensus about the value of the asset. All the trader needs to do now is account for the new information she has. That new information might be as basic as someone who wants to buy or sell some incremental amount of the asset for some reason.

Other times the task is incredibly difficult. There is significant new information about the asset, but the implications of that information are not yet well understood or well agreed upon by the market. The event is unprecedented, and the asset has almost no history of trades.

The news may be good. A successful private company wants to enter the market with its first publicly traded asset. Fortunately for our trader, there is a well-worn path to figure out a price. And there is ample time to do so. A roadshow is scheduled. Meetings with potential investors are held. Financial information is shared. Price negotiations are entered into. And indications of interest are gathered. At the end of this process a market clearing price is determined. Despite the time and information sharing, sometimes the result is unsatisfactory. The asset might immediately trade higher causing the seller to regret leaving money on the table (though sometimes this is by design). Or the price might immediately decline causing the buyer to suffer remorse. But generally, this long, thoughtful process yields satisfactory results for all parties.

Or the news may be bad. It may be a binary event that has been understood to be a possibility, a drug trial may have failed. Or it may come as completely unexpected news with many possible future states for the financial asset all with varying degrees of probability. A town that has issued municipal bonds may have tragically burned to the ground (Paradise, CA). Or those same fires may have created a liability for a public utility that it is unlikely to be able to meet (PG&E). There may be extended negotiations, legislative intervention or government aid available, but all those things take time and are for traders in the future to consider. Right now, our trader’s phone has rung, and a client has demanded a price. How does our trader price uncertainty?

The answer to that question is often revealed in the bid/ask spread for the asset. In the face of uncertainty, the trader will typically widen the spread between their bid and their offer. In equities, where spreads are available on a pre-trade basis, the measurement of this effect is relatively straight forward. In bonds, where pre-trade transparency is not the norm, it can be more difficult to measure.

BondWave has developed an algorithm that measures bid/ask spreads on a post trade basis. The resulting data is part of BondWave’s QTrades™ product. Using pattern recognition technology, we can assign approximately 75% of dealer to dealer trades in corporate, agency and municipal bonds to either the bid side or the offer side of the market. Once individual trades are assigned to a category they can be grouped into bid/ask spread combinations. This allows us to indirectly measure the trader’s response to new information.

Individual Bonds

One recent event allows us to examine how traders react in at least two asset specific situations to adjust the cost of uncertainty. The Camp Fire in California recently devastated large areas of the state.

Paradise

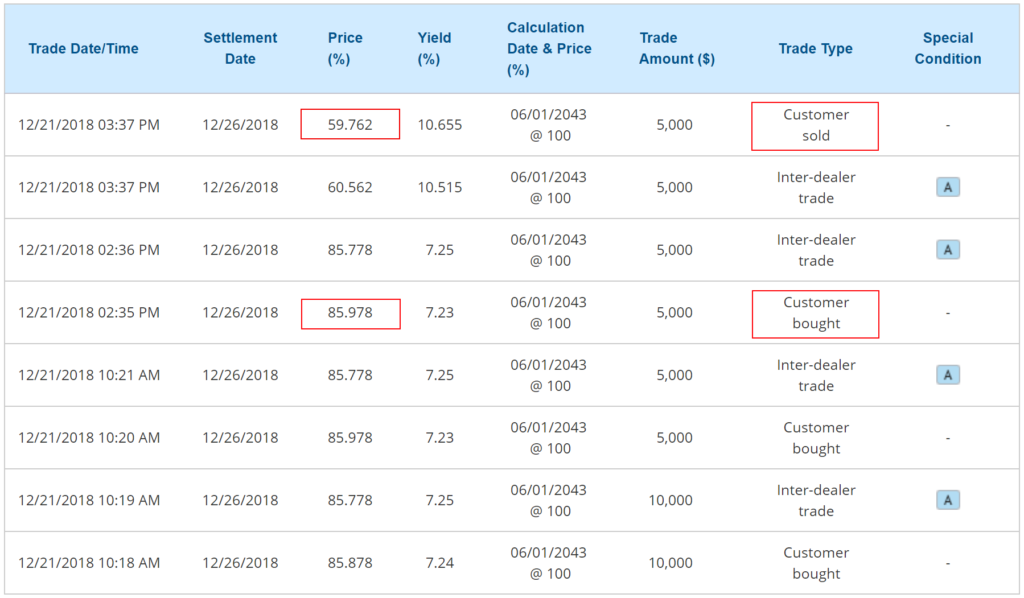

The town of Paradise was essentially burned to the ground. Paradise has outstanding municipal bonds. The town also contributes significantly to California Statewide Development Authority Pension Obligation Bonds. The effective elimination of the Paradise tax base leaves a tremendous amount of uncertainty as to the fate of these bonds. In the near term it is fully expected that the town will have to default on its obligations. But in the medium and long term the amount and types of insurance at the town and individual levels will impact their ability to meet obligations. The political and personal will to rebuild the town will also come into play. All these considerations have a wide range of possible outcomes that are very difficult to predict and model. But the market marches on and price discovery continues. But as can be seen below in the only Paradise bond that has traded to date the uncertainty leads to an effective bid ask spread for retail clients of almost 44%.

On December 21, 2018 the round-trip trading cost for a retail sized trade in Paradise Redevelopment Project 2009 Tax Allocation Refunding Bonds (CUSIP 699038AL9) was 43.87%. Source MSRB

PG&E

Wildfires are also the source of uncertainty for Pacific Gas & Electric. California law makes utilities liable for any damage caused by their equipment. While no determination has been yet made in the Camp Fire, investigators have linked PG&E equipment to more than a dozen other fires. As a result, the CEO resigned, and the company filed for bankruptcy although PG&E appears to be solvent on the surface. In the bankruptcy filing the company’s assets were listed at approximately $20 billion greater than its liabilities. What is unknown is the ultimate extent of their wildfire related liabilities. Some put the total around $15 billion while the company thinks it could be $30 billion or more.

The equity market is betting on a lower number. With an equity market capitalization of almost $7 billion at the end of January, investors are betting there will be money left over even after all the wildfire claims are settled. While the outcome of lawsuits and bankruptcy proceeding may take months (years?) to settle, the asset markets need to produce an answer every day. And we saw above for the equity the answer stands at $7 billion. So how is a market-maker to price the claims that are senior to the equity?

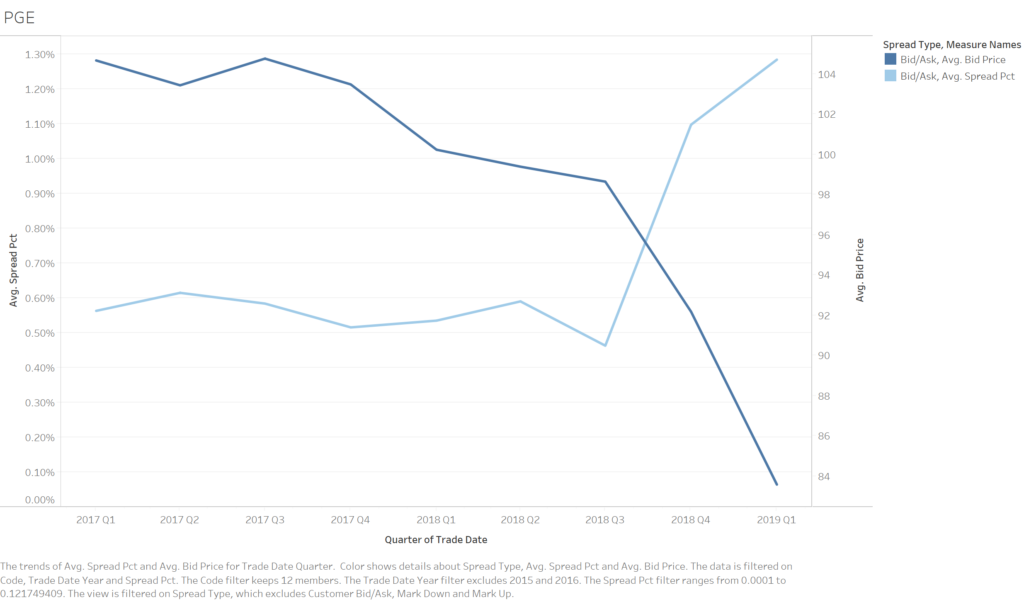

Certainly, one way is through the price of the bonds. In the second quarter of 2018, PGE bonds were trading near par. Now they trade near 84 cents on the dollar. But that is really the price of uncertainty to the investor. We want to examine the price of uncertainty to the liquidity provider.

At the same time the price has plunged, the bid/ask spread has more than doubled from approximately 60 basis points to more than 120 basis points.

Source: FINRA, BondWave’s QTrades™

General Electric

General Electric allows us to examine the cost of uncertainty in a less severe scenario and with more information. For the company Thomas Edison started, 2018 was a particularly difficult year. Several of their businesses are suffering leading to multiple multi-billion dollar charges against earnings, the pension plan is severely underfunded, and the board hired a new CEO in October to attempt to turn the company around. After being rated AAA as late as 2009 the credit rating of GE has slid all the way to BBB, just above junk status. And as a final indignity, after a 111 year run in the Dow Jones Industrial Average the stock was removed from the index last June.

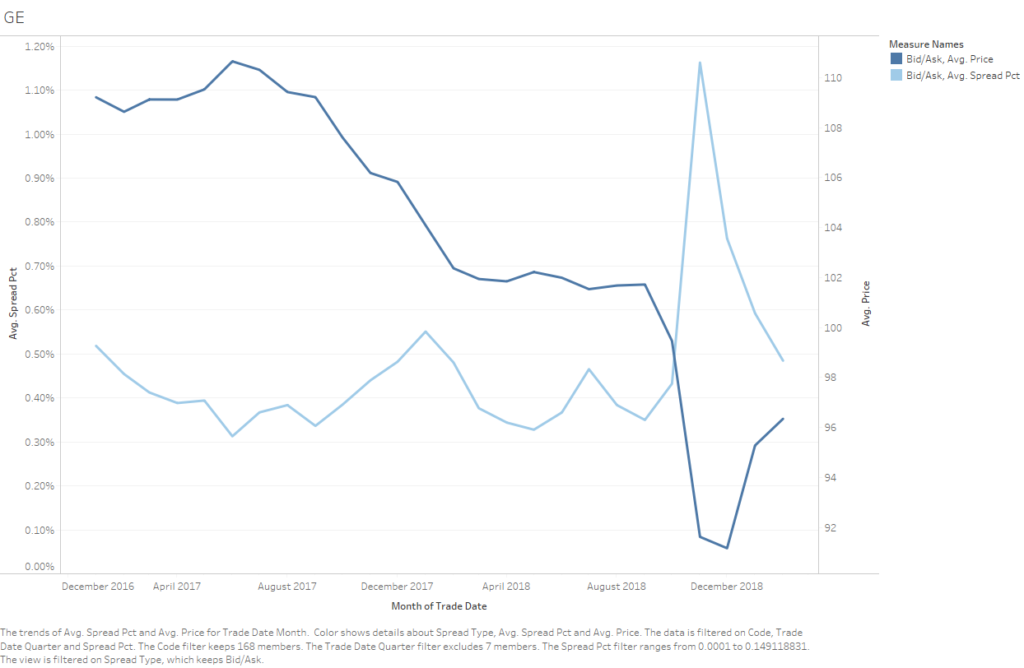

The bond market had its strongest reaction to this multi-year decline in September when S&P downgraded the company’s debt two levels from A- to BBB. Facing an uncertain future where continued financial decay was one possible outcome, bond prices predictably slumped. At the same time market makers reacted to the uncertainty surrounding the company by widening bid/ask spreads on GE bonds. From around 40 basis points prior to the S&P downgrade, the bid ask/spread widened to over 110 basis points.

This situation differs from the prior two in that immediate action could be taken by the board to right the situation. In October they hired Larry Culp to run the company. And in his two earnings calls since, in which he has announced a series of steps meant to solve GE’s long-term problems, he seems to have removed some uncertainty from the market. That is not to say that all of GE’s problems have been solved, only that some uncertainty has been removed. While bond prices have recovered some, bid/ask spreads have had a more significant snap back, recovering to near their long term average (60 basis points).

Source: FINRA, BondWave’s QTrades™

Macro Events

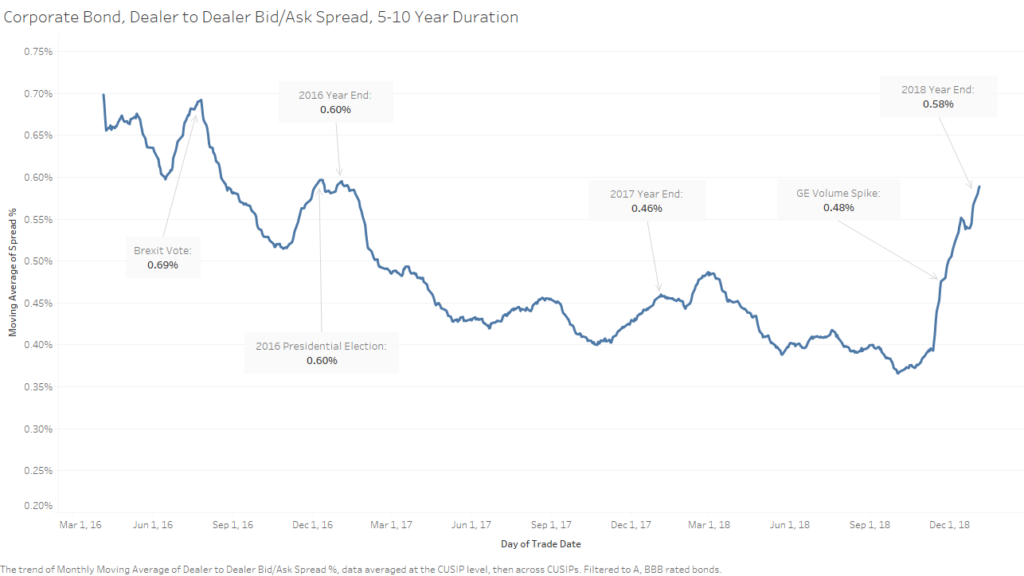

In addition to issuer specific risks that get reflected in the way market-makers price their bonds, the bond market maker faces broad, market-wide forces that add to the uncertainty they face. Recent examples include the Brexit vote, the Presidential election of 2016, and the temporary closing of the federal government. Without examining specific bond prices as we did above, we can examine the general level of uncertainty in the market as a result of these broad forces. To do this BondWave has developed a series of fixed income bid/ask spread indexes. Below is an example of the Corporate Bond, Dealer to Dealer Bid/Ask Spread Index for bonds with effective maturities between 5 and 10 years. In this time series we notice a general decrease in spreads between early 2016 and late 2018. The trend is occasionally interrupted by events that have the potential to change the markets in uncertain ways.

In the absence of specific analysis in the moment of the impact of these events the natural reaction of the market maker is to account for the uncertainty by widening their bid/ask spreads. This effect is often temporary as the market tends to quickly adjust to a new reality. A perfect example of this is the 2016 Brexit vote. Across the market, bid/ask spreads jumped 10 basis points in reaction to the surprise outcome of the vote, before reverting almost as quickly. That the ultimate outcome of that vote is still being negotiated over two years later illustrates the broad market’s ability to assimilate the uncertainty and move on with price discovery.

Source: FINRA, BondWave’s QTrades™

Conclusion

Price moves signal the collective belief about the value of an asset.

Bid/ask spreads signal the uncertainty about that collective belief.

We examined four scenarios where the cost of uncertainty revealed itself. From the most uncertain and specific to the broadest and least specific;

- Paradise, CA: what happens when an issuer essentially disappears? Your guess is as good as mine. Hence, a cost of uncertainty of more than 40%,

- PG&E: an entity facing a massive, but uncertain sized, liability but also having multiple tools to deal with the problem (bankruptcy, legislations, insurance, negotiations, etc.) leading to a doubling of the cost of uncertainty,

- GE: a company facing a years long decay punctuated by some significant events and an immediate response to those events causing the cost of uncertainty to take a significant jump before reverting most of the way back,

- Macro Events: the market faces broad concerns daily and tends to quickly adjust causing the cost of uncertainty to adjust relatively quickly.

Uncertainty is a real cost to investors. And it needs to be managed and researched as much as the price of the underlying asset. Furthermore, understanding the likely dynamics of the cost of uncertainty allows for better trade timing decisions. While it may not be absolutely true that you cannot manage what you cannot measure, it does seem that measurement does make management easier.

The challenge in the fixed income markets is that there is very little information available pre-trade about the cost of uncertainty. Unlike in the equity markets where the bid/ask spread is displayed freely and without needing to announce an intent to trade, fixed income markets tend to reveal themselves only after the fact. This happens individually when an investor announces an intent to trade and requests pricing. But it can also happen for all of us after the trades are completed and the resulting price signals are digested properly.

BondWave aims to provide the measurement of the cost of uncertainty with its QTrades™ product.