Developed to help bond market participants better understand trading trends in the fixed income markets, BondWave’s Data Lab has released its QMarksTM dashboards for the second quarter of 2025.

QMarks is a proprietary BondWave data set that powers its quarterly dashboards to cover all disseminated bond transactions using the regulatory-prescribed Prevailing Market Price methodology for corporate, municipal, agency, and 144A. QMarks belongs to a suite of other BondWave proprietary data sets, including QCurves, QTrades, and QScores.

Q2 2025 Observations:

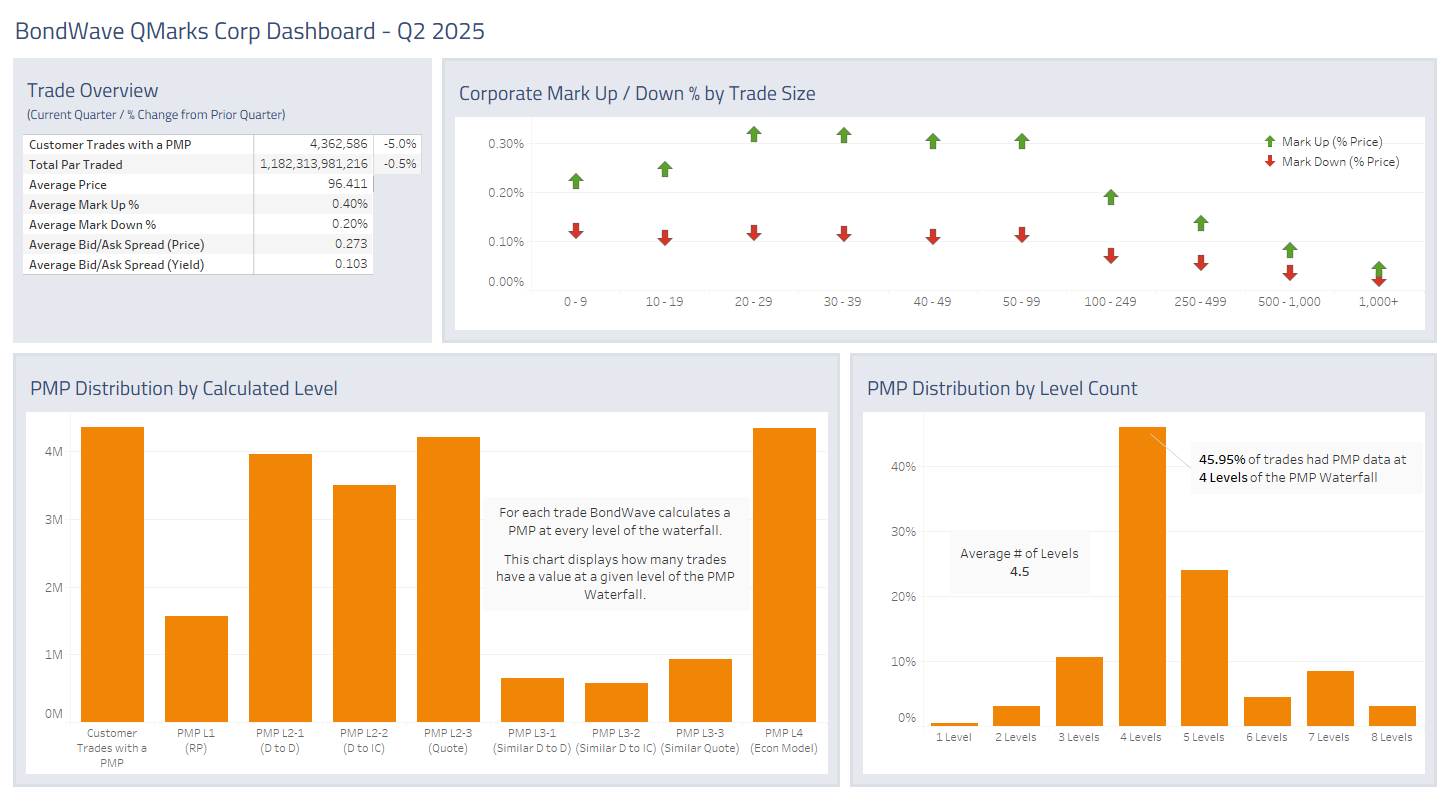

Corporate Bond Market Trends

Source: BondWave QMarks

- Corporate bond trade counts were down 5% in Q2 2025.

- But as average trade size rebounded from 2024 lows, total par traded only shrank 0.5%.

- Average customer trade size is 6.6% larger than Q2 2024, but still 2.5% smaller than Q2 2023.

- While overall mark-ups and mark-downs remain unchanged, mark-ups on 0-9 year maturities jumped from 17 bps to 22 bps.

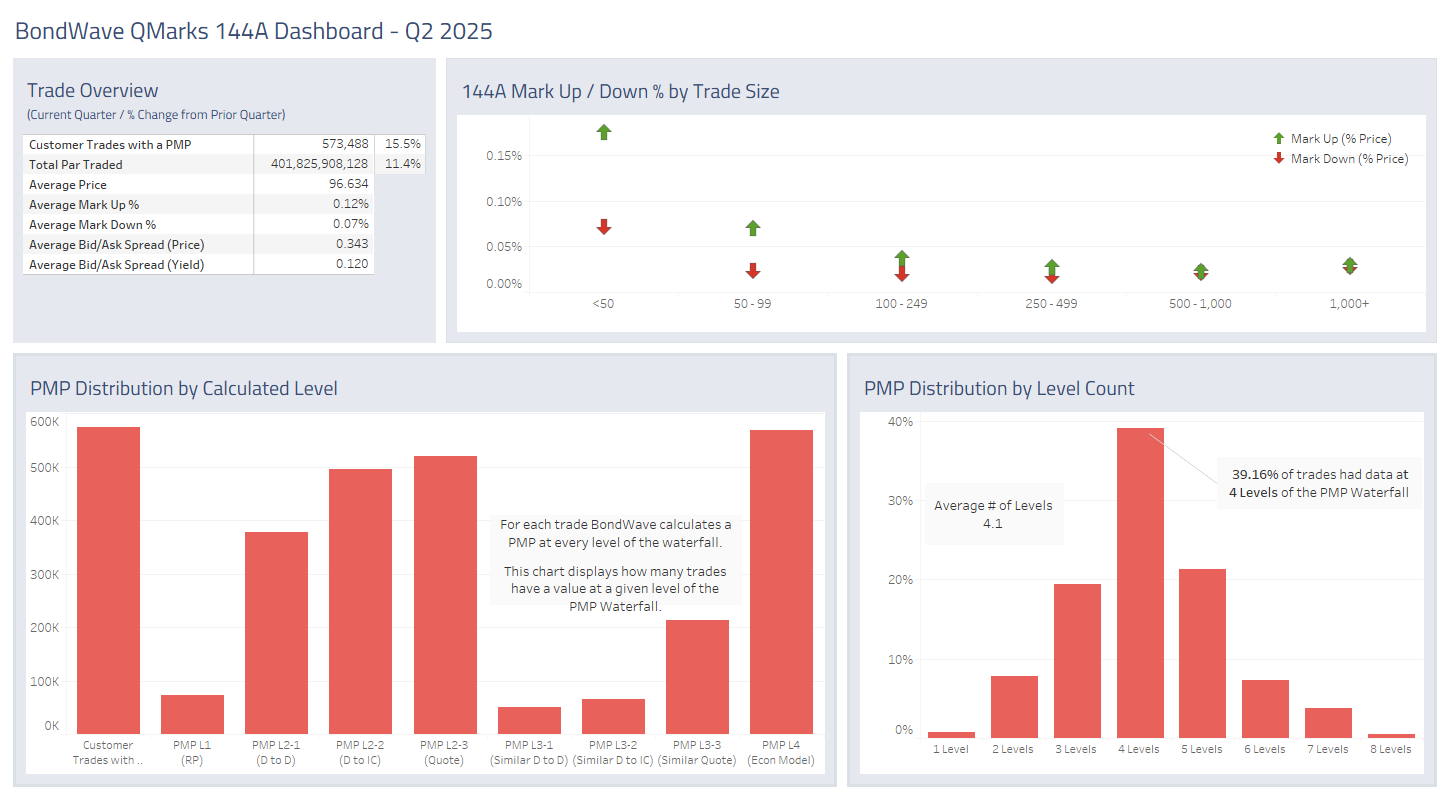

144A Bond Market Trends

Source: BondWave QMarks

- The unregistered portion of the corporate bond market bucked the trend of the registered portion.

- Total trades grew 15.5% for the quarter.

- Total par traded grew 11.4% for the quarter.

- Both figures represent record volumes.

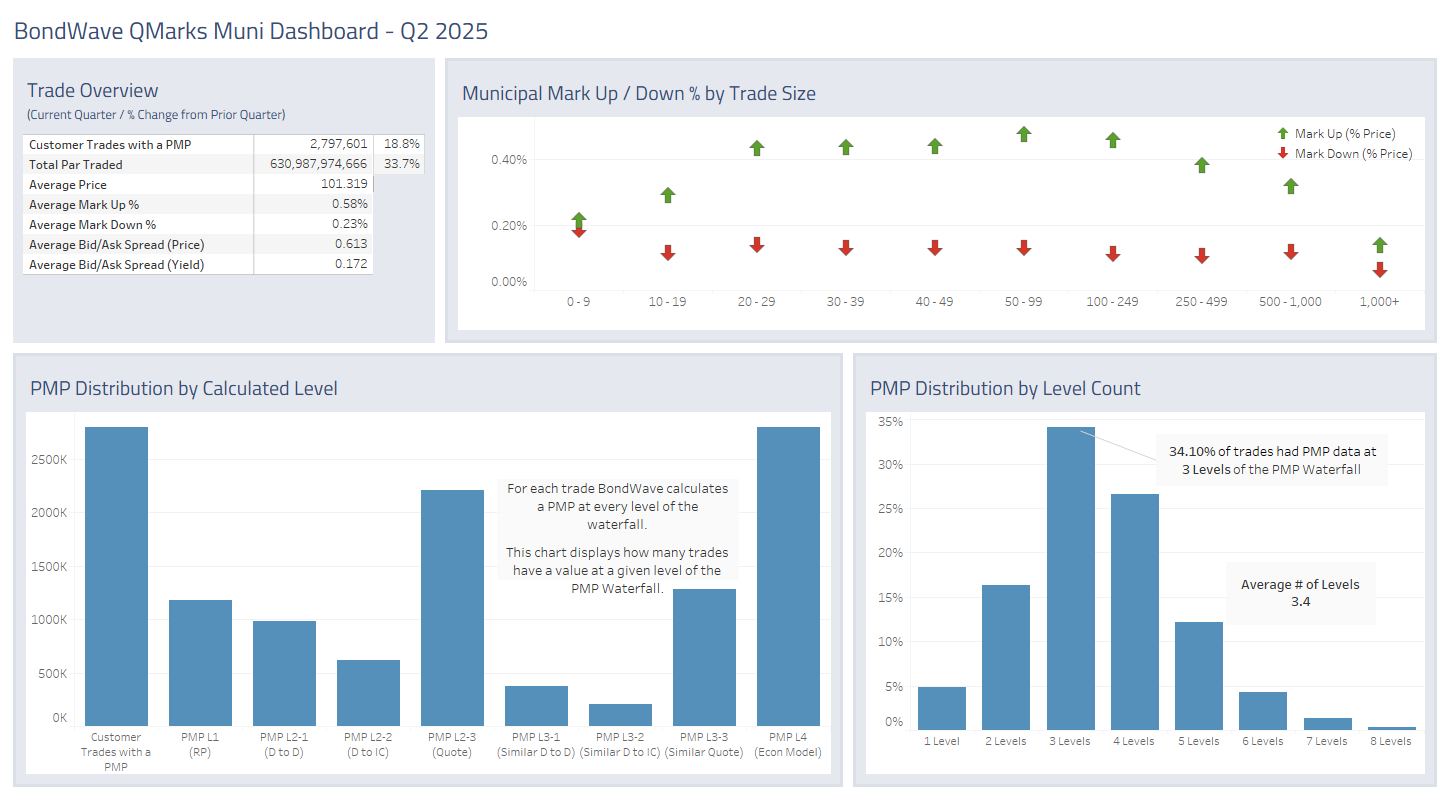

Municipal Bond Market Trends

Source: BondWave QMarks

- Municipal trading saw robust growth in the second quarter.

- Both trade counts (+18.8%) and par traded (33.7%) jumped to record levels.

- In spite of the volume increases mark-ups and mark-downs remained steady.

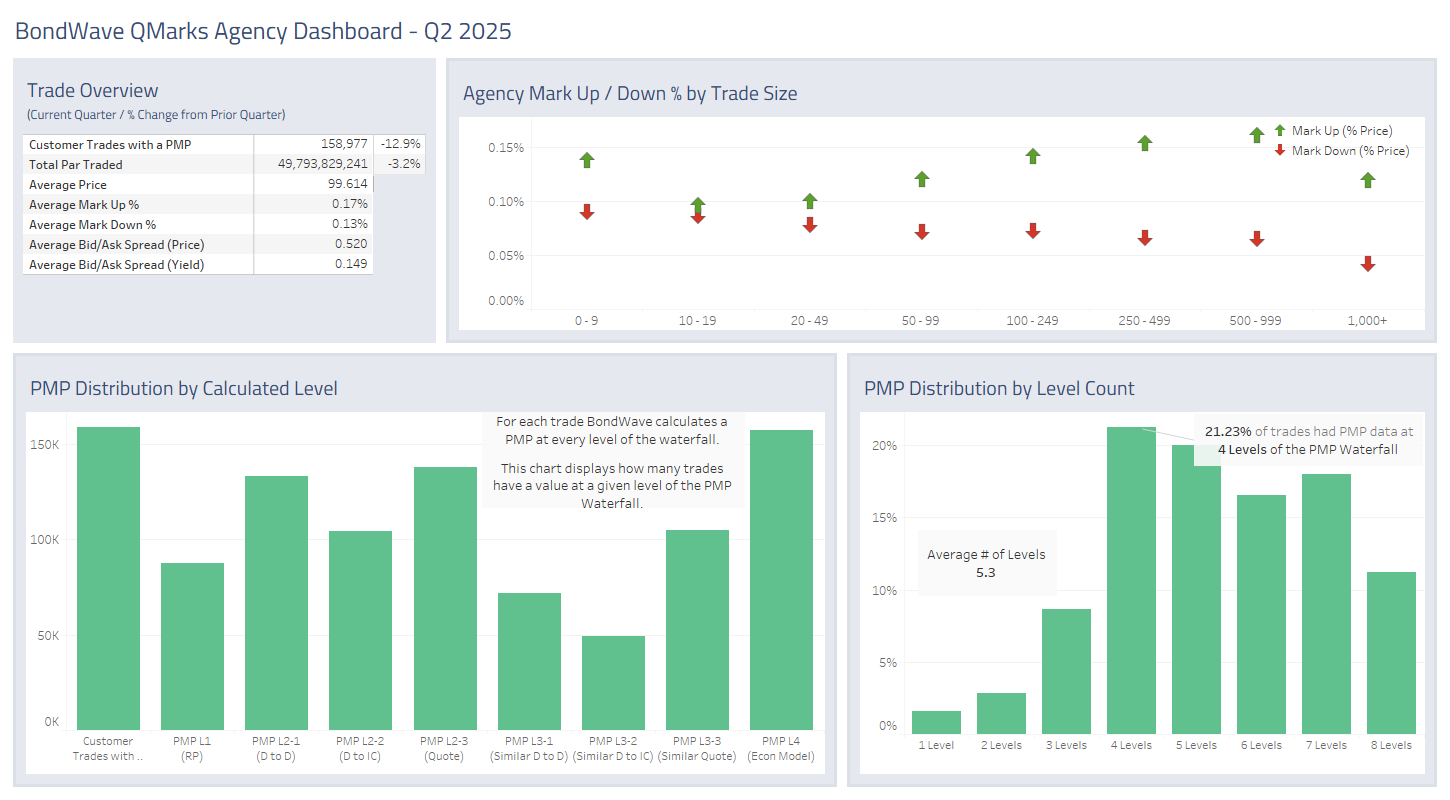

Agency Bond Market Trends

Source: BondWave QMarks

- Agency trade totals shrank 12.9% in the second quarter.

- Total par traded shrank 3.2% as well, following the same pattern as corporate bonds with smaller total par traded and higher average trade size.

The dashboards for the previous quarters referenced above are located here:

Last quarter: Q1 2025 Dashboards

Year-over-year: Q2 2024 Dashboards and Q2 2023 Dashboards

About BondWave LLC

Founded in 2001, BondWave® is a financial technology company focused on fixed income solutions that empower our clients to more efficiently manage and grow their fixed income business. We serve a wide range of clients, including traders, compliance professionals, RIAs, and asset managers, who use our tools to provide a superior fixed income experience to their clients while supporting critical regulatory mandates and optimizing workflows.

Effi®, our Engine for Fixed Income, is the single platform through which we deliver all our solutions – providing intuitive dashboards and insights into every fixed income position and transaction to drive informed investment and business decisions. Effi’s capabilities include Portfolio Oversight, Trade Oversight, and curated Muni News. Our solutions are fueled by proprietary data sets that are developed using AI, machine learning technologies, and advanced data science.